Total Cost of Ownership (TCO) for Fleets and Policy Literacy: Shaping Fleet Financing and Growth

Picture a fleet on a dawn road with headlights cutting through mist and a decision waiting at the toll plaza. Financing for fleets today hinges on more than sticker price. Policy literacy—understanding depreciation rules, tax incentives, and regulatory signals—drives the total cost of ownership over a vehicle’s life. The Congressional Trucking Caucus provides a forum where lawmakers and industry partners map how rules shape cash flow risk and growth. When tax code changes arrive fleets tighten their belts or unlock new paths for expansion. Writing off costs, depreciation timing, and fuel credits matter now. This is why collaboration between fleets lenders and policymakers matters for long term profitability. As you read keep policy literacy as the central throughline guiding every financing decision and equipment choice.

Glossary

- Total Cost of Ownership (TCO): the all in cost of owning a fleet vehicle over its life, including purchase, financing, depreciation, fuel, maintenance, taxes, and insurance.

- Section 179: a tax provision allowing expensing part of the vehicle cost in the first year up to limits.

- Bonus depreciation: accelerated first year deduction for qualifying property, reducing upfront tax cost.

TL;DR

- Policy literacy plus depreciation timing drives TCO.

- Key incentives include bonus depreciation, Section 179, and policy certainty that improves budgeting and financing terms.

- Actions: map depreciation schedules, align with lenders on tax shields, test scenarios under policy changes, and weigh leasing versus buying for upfits and modernization.

What this means in practice is that policy literacy becomes the practical engine behind budgeting and decision making. When operators, finance teams, and lenders share a clear view of depreciation timelines and incentives they can forecast cash flows, time technology upgrades, and preserve margins even in policy flux.

Why policy literacy matters

Policy literacy matters because tax rules and depreciation timing directly shape carry, cash flow, and risk. Clear understanding of the rules helps fleets plan purchases, financing terms, and upgrade cycles with confidence. It also strengthens the partnership between fleets and lenders by aligning expectations and reducing surprises when regulations shift.

How depreciation touches budgeting

Depreciation timing changes the cash flows fleets see in early years and affects the apparent cost of ownership more than sticker price alone. Incentives such as Section 179 expensing and bonus depreciation tilt the economics in favor of newer equipment or alternative powertrains. Policy certainty reduces budget risk by clarifying future tax treatment, which improves lender confidence and planning accuracy.

What this means for your planning

Lenders price risk around tax shields and depreciation expectations rather than sticker value alone. Fleets that map depreciation timelines, forecast tax benefits, and scenario test different policy outcomes can improve financing terms and flexibility. This throughline connects policy to practice in budgeting, capital planning, and equipment strategy.

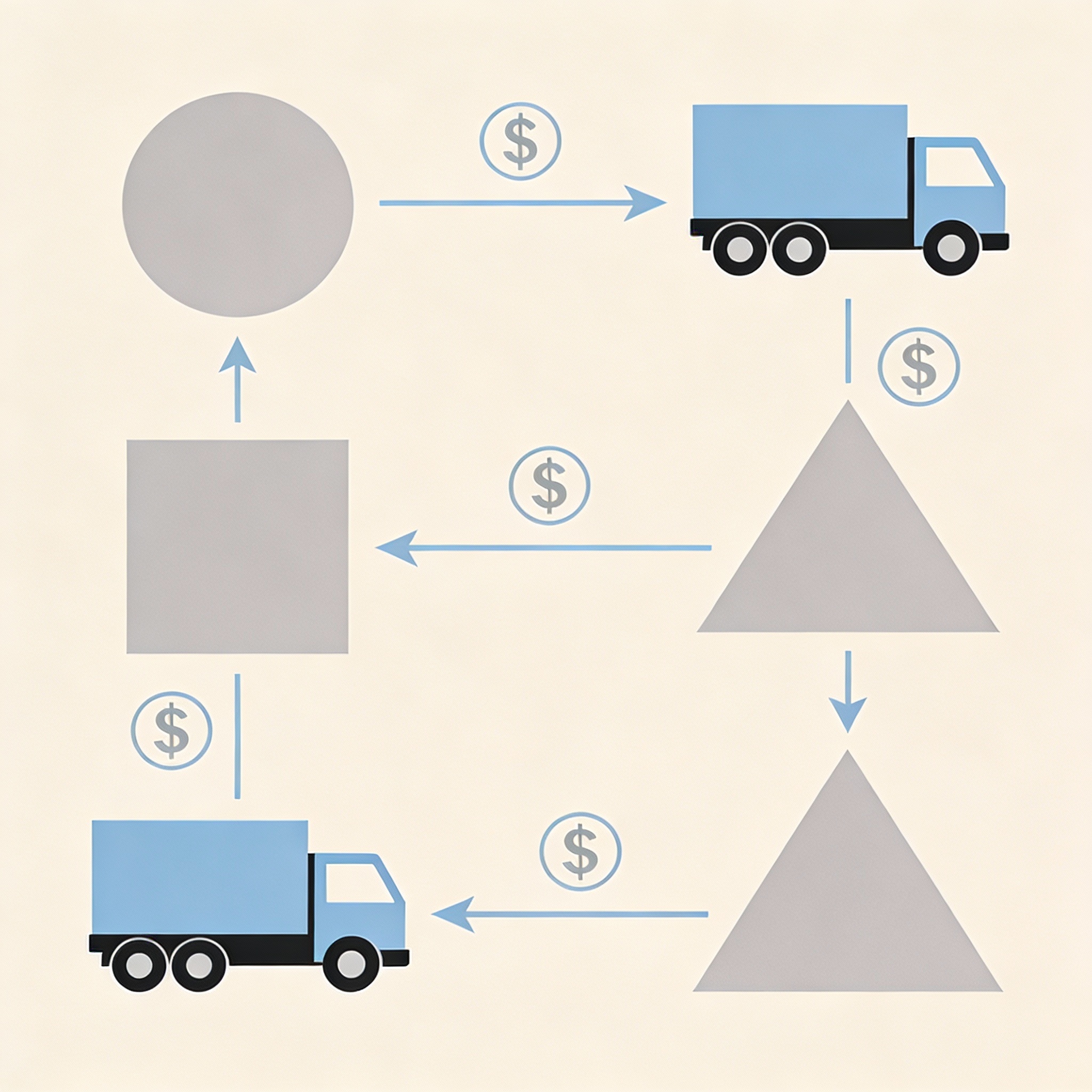

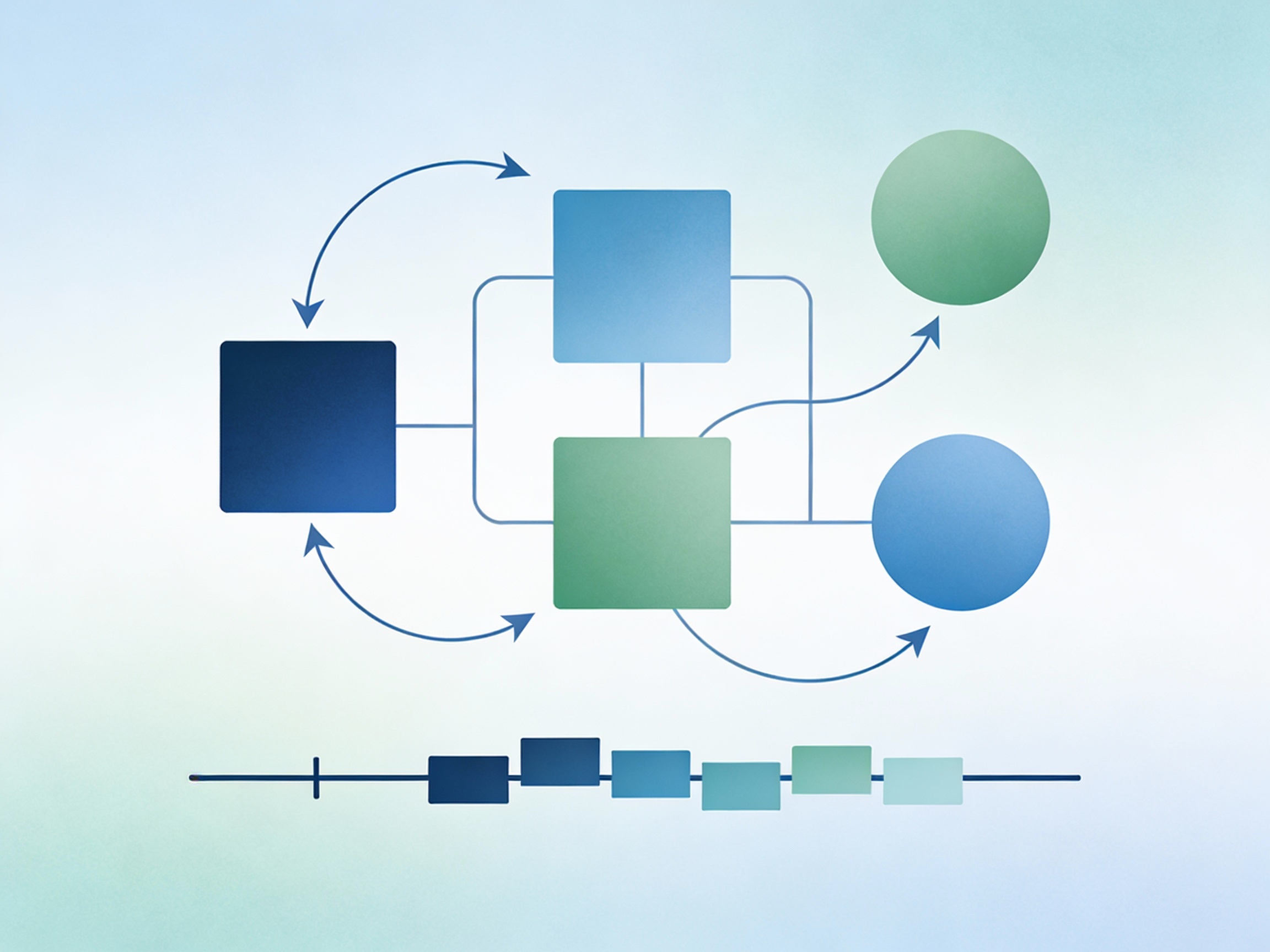

Visual context

Source: EIA diesel price data

Takeaway The core idea is that tax policy and depreciation timing shape fleet economics as much as the road does, guiding what fleets buy how they finance and how profits are protected. When lawmakers connect with industry partners through the Congressional Trucking Caucus the path to durable profitability becomes clearer. Policy literacy becomes a competitive asset in budgeting and growth.

Tax implications sit at the center of fleet financing decisions. Depreciation schedules alter the timing of cash flows and the apparent cost of ownership, which matters more than sticker price alone. Incentives such as bonus depreciation and expensing can tilt the economics in favor of newer vehicles or alternative powertrains. Policy signals bleed into lenders risk assessments by changing residual values and the expected tax savings. Operators learn to trade off upfront write offs against long term depreciation to protect margins.

- Accelerated depreciation speeds up tax relief in early years, improving financing spreads

- Bonus depreciation can lower first year cost of capital for eligible fleets

- Fuel and energy incentives influence choices toward efficiency or alternative propulsion

- Policy certainty reduces budget risk by clarifying future tax treatment

These forces help explain why fleets may prefer one vehicle segment over another and why some fleets move toward electrified options or advanced aerodynamics even when upfront costs are higher.

Policy signals also shape vehicle mix and lifecycle decisions. Fleets weigh initial cost against tax relief timing anticipated resale values and maintenance expectations.

- Tax credits and incentives can push fleets toward electrified or alternative fuel options

- Depreciation life and salvage values influence when to replace equipment

- Regulatory changes raise compliance costs that affect total cost of ownership

- Lenders price risk using the tax cash flow profile rather than sticker value alone

In planning budgets operators trace tax cash flows alongside fuel costs maintenance and financing payments to map a steady path through uncertainty. These fiscal rhythms help projects survive downturns and seize growth moments.

Lenders price risk and budgeting around policy certainty. If a fleet can demonstrate reliable depreciation benefits and stable policy expectations credit terms improve while volatility raises hurdles.

- Lenders model tax shields into debt service calculations

- Uncertainty about future rules increases hurdle rates

- Budgeting processes incorporate expected tax cash flows to smooth projections

- Treasury and tax compliance costs are factored into overhead estimates

Taken together these dynamics connect policy and performance. The Congressional Trucking Caucus serves as a forum to align legislative signals with industry realities, supporting trucking integrity safety and growth. Partnerships between fleets and financing providers enable more predictable expansion and resilience for the trucking economy. CDL drivers remain central to profitability through stable demand and effective financing.

This insight section bridges to the evidence section by showing why the data on depreciation incentives diesel prices and policy shifts matters for every fleet decision and every lender conversation.

Evidence matters when linking policy ideas to the road ahead. The trucking sector underpins both commerce and regional development. In 2024 America’s trucking industry generated nearly 906 billion dollars in revenue and supported about 8.4 million jobs, creating a backbone for supply chains across the nation.

Key data points ground policy discussions in credibility and demonstrate the scale of impact. The numbers are not abstract models; they reflect real fleets, real drivers, and real financing needs that shape budgets and business decisions at every level.

- Revenue: roughly 906 billion dollars in 2024

- Jobs supported: about 8.4 million

- Diesel price context: national and regional variations matter for budgeting

Diesel prices act as a central force in fleet economics. As of December 15, 2025 the national average for diesel stood at $3.61 per gallon, a benchmark that operators use to test economics across routes and vehicle types. Regional variations matter too. The Rocky Mountain region recorded the largest price decline at 11.3 cents per gallon, while California remained the most expensive market at $4.78 per gallon. The Gulf Coast region offered the cheapest diesel at $3.27 per gallon, a spread that can influence equipment mix and route planning.

“I’m proud to launch the Congressional Trucking Caucus alongside my colleagues to create a forum for discussing policy solutions to keep all drivers safe on American roads, support hardworking truck drivers, and ensure the accessibility of reliable transportation across our Nation.”

The Caucus serves as a practical bridge between lawmakers and industry concerns, translating tax policy and depreciation timing into tangible budgeting and investment signals for fleets large and small.

“This partnership allows us to offer a seamless, customer-centric financing experience that aligns with our commitment to operational excellence.”

In the context of financing partnerships this perspective highlights how lenders and fleet operators work together to optimize cash flow, reduce risk, and expand access to modern equipment and powertrains.

These voices sit alongside the work of associations and industry leaders named in the record. The Congressional Trucking Caucus champions dialogue on integrity, safety, and growth, while groups such as the American Trucking Associations, the Truckload Carriers Association, and the Owner-Operator Independent Drivers Association frame the policy discourse. Leading manufacturers and suppliers from the named entities like Hyundai Translead, Hyundai Capital America and the product line including Xcient fuel cell truck, dry and refrigerated van trailers, flatbeds, truck bodies and dollies remind readers that capital markets, equipment supply, and innovation all intersect in our fleets.

Together the data, the quotes, and the ongoing caucus dialogue ground the argument that tax policy yes matters for fleet economics yet policy certainty and collaboration between fleets and lenders are essential to preserve service levels, drive efficiency, and support a resilient trucking economy.

Payoff and Actionable Steps to Optimize Taxes on Commercial Vehicle Financing

A practical payoff for fleet managers is to translate tax policy into measurable cash flow and growth opportunities. By aligning financing decisions with depreciation rules and staying coordinated with policy conversations such as the Congressional Trucking Caucus, fleets can protect margins, accelerate modernization, and reduce risk. This payoff also ties directly to the broader trucking ecosystem and related keywords such as trucking integrity safety growth trucking economy Congress CDL drivers Hyundai Translead financing partnership diesel prices fuel prices Owner-Operator Independent Drivers Association American Trucking Associations Truckload Carriers Association trucking industry issues employment supply chains commercial fleets retail loans leases and the full set of related considerations.

- Depreciation choices

- Section 179: Choose to expense a portion of vehicle cost in the first year within applicable limits. This can reduce early tax liability and improve initial cash flow, especially for fleets purchasing multiple vehicles or upgrading to newer powertrains. Ensure eligibility based on vehicle use and tax rules for the year and verify current limits with your CPA.

- Bonus Depreciation: Leverage accelerated first year deductions for qualifying property when available. This can significantly lower upfront capital costs and improve financing spreads in the near term. Track asset class eligibility and any phase down or rule changes with your tax advisor.

- Leasing versus buying considerations

- Cash flow and budgeting: Leasing often lowers upfront cash requirements and keeps fleets flexible for technology upgrades, while buying builds equity and may unlock greater long term tax benefits through depreciation on owned assets. Assess mileage, maintenance costs, and expected lifecycle to determine which path supports your total cost of ownership.

- Residual risk and maintenance: Leasing typically shifts some risk to the lessor, but may include mileage limits and wear charges. Buying transfers residual risk to the fleet but allows full depreciation and potential resale value realization.

- Regulatory and powertrain strategy: If you anticipate policy changes or a shift toward electrified powertrains, leasing can offer a faster path to upfits and technology testing without tying capital to aging equipment.

- Tracking and record-keeping

- What to track: vehicle cost, acquisition date, depreciation method, mileage logs, maintenance spend, fuel costs, and any tax credits or incentives claimed. Maintain a centralized ledger for each asset.

- How to implement: use a digitized asset register that links to your general ledger, with reminders for annual depreciation reconciliation, mileage verification, and year end tax reporting. Clean, auditable records reduce risk during audits and improve lender confidence.

- Consulting a CPA and cross functional collaboration

- How to select a CPA: choose a practitioner with fleet financing experience and a track record of collaborating with lenders and operations teams. Seek a CPA who can translate policy shifts into actionable budgeting guidance.

- What to prepare: gather vehicle profiles, financing terms, depreciation schedules, and policy expectations from the Congressional Trucking Caucus; share updates with your finance, tax, and operations teams to maintain alignment.

- Quick capability payoff

- Build policy literacy alongside financing strategy to shift from reactive tax planning to proactive optimization. By integrating depreciation planning, sound leasing decisions, and meticulous record keeping with CPA guidance, fleets can improve after-tax cash flow, expand modern equipment, and support sustainable growth for the trucking economy.

| Financing Option | Tax Treatments | Depreciation Timeline (years) | Pros | Cons |

|---|---|---|---|---|

| Loan | Interest deduction; depreciation deduction on the asset; Section 179 eligibility and possible bonus depreciation in eligible years | 5 | Ownership preserved; tax shields from depreciation and interest; flexibility in asset use | Higher upfront cost; ongoing loan interest; market risk on resale value |

| Lease | Lease payments deductible as operating expenses; no depreciation deduction; limited additional tax benefits beyond regular expensing | N/A | Lower upfront cash; upgrades easier; easier budgeting | No ownership; mileage limits; possible end of lease charges |

| Buy | Depreciation deduction; Section 179 expensing and bonus depreciation where eligible | 5 | Ownership; depreciation and potential resale value; long term cost advantage | Higher upfront cash needs; risk of obsolescence; depreciation limits; maintenance cost responsibility |

Conclusion

As this exploration shows, tax policy and depreciation timing are not abstract accounting terms; they are powerful levers that shape fleet decisions, cash flow, and growth trajectories. The core takeaway is that the total cost of ownership is determined not only by the sticker price of a vehicle but by how depreciation rules, incentives, and policy signals align with financing terms. When fleets understand these mechanics, they can time purchases, optimize budgeting, and move with greater confidence through shifting regulatory landscapes.

The journey toward durable profitability becomes clearer when industry players and policymakers collaborate. The Congressional Trucking Caucus represents a practical forum where fleets, lenders, manufacturers, and trade associations can align on safety, service, and growth. Partnerships with industry leaders such as Hyundai Translead, Hyundai Capital America, the Owner-Operator Independent Drivers Association, the American Trucking Associations, and the Truckload Carriers Association translate policy conversations into concrete financing options and equipment strategies. These relationships help ensure that fleets access modern equipment while maintaining resilience in budgeting and risk management.

To readers ready to act, a straightforward path exists. First, map your current depreciation schedule, financing terms, and expected policy shifts so you can forecast cash flows under different scenarios. Second, explore financing options with lenders who understand fleet needs and can model tax shields, Section 179 expensing, and bonus depreciation within current law. Third, decide whether leasing or buying best aligns with your fleet’s lifecycle, flexibility needs, and maintenance plans, while keeping an eye on residual risk and technology upfits. Fourth, engage a CPA or tax advisor who can translate evolving rules into actionable plans and coordinate with your operations team for alignment.

Finally, lean on industry networks. Reach out to Hyundai Translead for equipment solutions, to Hyundai Capital America for financing partnerships, and to associations like OTA, ATA, and TCA for guidance and best practices. These collaborations turn policy literacy into practical advantage and help keep American fleets competitive.

Call to action: start a scenario planning session with your finance and operations teams today, contact your preferred lender about depreciation friendly terms, and schedule a consultation with a qualified tax professional to begin turning these insights into tangible improvements.

-

Q: What triggers tax implications for commercial vehicle fleets?

A: Depreciation timing, Section 179 limits, and bonus depreciation shape cash flow and tax shields for growing fleets.

-

Q: How does depreciation affect total cost of ownership?

A: It spreads price recovery over years, lowers taxable income, and can improve financing.

-

Q: What is Section 179 and when should I use it?

A: You can expense part of the vehicle cost in year one within limits, reducing early tax liability for fleets buying multiple units.

-

Q: What about bonus depreciation?

A: It provides accelerated first-year deductions for qualifying property, reducing upfront capital costs and easing near-term financing.

-

Q: Leasing vs buying—which saves more in taxes?

A: Leasing lowers upfront cash and preserves flexibility; buying enables depreciation deductions and possibly higher resale value.

-

Q: How should I treat diesel price changes in budgeting?

A: Monitor national averages and regional gaps; use current benchmarks to update projections.

-

Q: Do diesel price trends affect equipment choices?

A: Yes, higher fuel costs push for fuel efficiency, electrified powertrains, and aerodynamics, shifting long-term planning.

-

Q: How can policy certainty help lenders and fleets?

A: Clear rules about depreciation and credits reduce risk, improve budgeting, and stabilize financing terms when lenders price risk around tax shields and expected law.

-

Q: Is leasing always better for up-to-date technology?

A: Leasing supports rapid upgrades for technology and powertrains, but ownership offers full depreciation, potential higher resale, and long-term tax planning benefits.

-

Q: What data matters for budgeting and depreciation?

A: Track vehicle cost, date, depreciation method, mileage, maintenance, fuel, and credits.

-

Q: Who can help implement these strategies?

A: A CPA with fleet-financing experience, plus collaboration with finance teams, lenders, and suppliers.

Congressional Trucking Caucus: Shaping Fleet Financing and Growth

H2 tag suggestions

- How policy signals from the Congressional Trucking Caucus influence depreciation and financing

- Key tax incentives for fleets in 2025 and beyond

- Industry voices and alliances powering policy literacy

- Practical steps to align fleet budgeting with policy changes

- Connecting fleet strategy with the Commercial Vehicle Financing pillar

Meta description

This guide explains how the Congressional Trucking Caucus informs fleet financing, depreciation timing, and policy certainty for commercial fleets. It highlights how tax rules such as Section 179 and bonus depreciation affect cash flow, asset selection, and total cost of ownership. The discussion weaves in industry voices from Dave Taylor to leaders at Hyundai Translead and Hyundai Capital America, with insights from the American Trucking Associations, the Truckload Carriers Association, and the Owner-Operator Independent Drivers Association. For practical budgeting and scenario planning, this page links to the Commercial Vehicle Financing pillar, offering actionable steps for lenders and operators to collaborate and grow.

Internal link suggestions

- Primary anchor: Commercial Vehicle Financing linking to /commercial-vehicle-financing/

- Additional internal connectors can include budgeting and depreciation planning pages under the same pillar to reinforce topical authority.

Named Entities embedded for authority

- People: Dave Taylor, Harriet Hageman, Pat Harrigan, Doug LaMalfa, Mary Miller, Shomari Figures, Todd Spencer

- Companies: Hyundai Translead, Hyundai Capital America, Owner-Operator Independent Drivers Association, American Trucking Associations, Truckload Carriers Association

- Products and related brands: Xcient fuel cell truck, dry and refrigerated van trailers, flatbeds, truck bodies, dollies

This framing ties the Congressional Trucking Caucus to real world financing decisions and industry leadership, supporting a robust topical authority around the Congress driving trucking policy and fleet growth. The content invites readers to explore the Commercial Vehicle Financing pillar for deeper planning and lender collaboration.

Regional and Regulatory Considerations

Regional and regulatory considerations influence fleet planning as much as the road ahead. Beyond sticker price, state incentives, depreciation rules, and industry standards shape the economics of every chassis, trailer, and powertrain.

Regional incentives vary by state and even by municipality. California’s aggressive clean truck programs, New York’s fleet electrification grants, and Texas incentive packages can tilt the economics toward alternative powertrains or upgraded maintenance strategies. Some states offer depreciation or property tax relief for fleets investing in eligible equipment, while others cap rebate programs or require matched equity. When planning acquisitions, document current programs, projected eligibility windows, and any sunset dates that could affect budgets.

Depreciation and tax treatment add another layer of regional nuance. Federal rules like Section 179 expensing and bonus depreciation often align with many states’ conformity, but differences exist. A few states decouple from federal timing or apply their own caps, altering cash flow and resale expectations. Engaging a knowledgeable CPA and tax advisor who understands multi state filings keeps depreciation timing aligned with state obligations and lender expectations.

Industry groups provide guidance and leverage. The American Trucking Associations (ATA) and the Truckload Carriers Association (TCA) offer policy updates, model contracts, and best practices that keep fleets compliant and competitive. The Owner-Operator Independent Drivers Association (OOIDA) connects independent operators with advocacy and resources. Regularly checking their alerts, attending webinars, and participating in regional chapters helps fleets stay ahead.

Practical next steps: map regional incentives, confirm state conformity with federal depreciation, and coordinate with your lender, CPA, and fleet associations to lock in favorable terms while remaining compliant.

Total Cost of Ownership (TCO) for Fleets

Total Cost of Ownership (TCO) for Fleets describes the all in cost of owning and operating a fleet vehicle over its life including purchase price financing costs depreciation fuel maintenance taxes and insurance. Viewing fleet decisions through the TCO lens helps managers balance upfront capital ongoing expenses and the risk and rewards of policy changes. It ties policy literacy directly to budgeting and strategic planning.

Fleet financing options

- Loan: ownership preserved; tax shields from depreciation and interest; Section 179 eligibility and possible bonus depreciation in eligible years

- Lease: lease payments deductible as operating expenses; no depreciation deduction; limited additional tax benefits beyond regular expensing

- Buy: depreciation deduction; Section 179 expensing and bonus depreciation where eligible

Policy literacy and depreciation schedules

Policy literacy means understanding depreciation schedules tax credits and regulatory signals that change cash flow. Depreciation timing can affect the pace of tax relief and the budget horizon; lenders incorporate tax shields into debt service and credit spreads. Keeping depreciation timelines aligned with financing terms reduces surprises and supports steadier budgeting.

Diesel price sensitivity and electrified powertrains incentives

Diesel price swings drive route planning fleet mix and maintenance strategies. When fuel costs rise fleets seek fuel efficiency aerodynamics and electrified powertrains where incentives exist. Electrified powertrains incentives include federal and state programs as well as depreciation and expensing opportunities. For fuel price context see the DOE/EIA diesel price data.

Regulatory certainty and Commercial Vehicle Financing

Regulatory certainty reduces budgeting risk and supports predictable financing terms. Lenders reward clarity on depreciation rules credits and incentives, while policymakers and industry groups shape a steady path for fleets. For practical planning see the Commercial Vehicle Financing.

Outbound sources and context

- Tax rules such as IRS Section 179 and Bonus Depreciation can lower upfront costs when fleets invest in qualifying assets.

- Source: IRS Section 179

- Source: Bonus Depreciation

- Fuel economics and price data are tracked by the Department of Energy and the Energy Information Administration so fleets can benchmark diesel price sensitivity over time. See DOE/EIA diesel price data.

- Source: DOE/EIA diesel price data

- Credible industry perspectives come from leading associations and research partners. For industry scale and trends see the American Trucking Associations (ATA) and the American Transportation Research Institute (ATRI) resources: ATA and ATRI.

This framing connects policy literacy with the practical economics of fleet ownership and operation. For related planning and lender conversations the term Commercial Vehicle Financing anchors your cross functional discussions around capital allocation and risk.

Total Cost of Ownership (TCO) for Fleets and Policy Literacy: Shaping Fleet Financing and Growth

Picture a fleet on a dawn road with headlights cutting through mist and a decision waiting at the toll plaza. Financing for fleets today hinges on more than sticker price. Policy literacy—understanding depreciation rules, tax incentives, and regulatory signals—drives the total cost of ownership over a vehicle’s life. The Congressional Trucking Caucus provides a forum where lawmakers and industry partners map how rules shape cash flow risk and growth. When tax code changes arrive fleets tighten their belts or unlock new paths for expansion. Writing off costs, depreciation cadence, and fuel credits matter now. This is why collaboration between fleets lenders and policymakers matters for long term profitability. As you read keep policy literacy as the central throughline guiding every financing decision and equipment choice.

Transitional note: From policy literacy to practical budgeting there is a natural flow into the actions that turn ideas into measurable results. The next section anchors these concepts in the language of budgeting and implementation.

<

Glossary

- Total Cost of Ownership (TCO): the all in cost of owning a fleet vehicle over its life, including purchase, financing, depreciation, fuel, maintenance, taxes, and insurance.

- Section 179: a tax provision allowing expensing part of the vehicle cost in the first year up to limits.

- Bonus depreciation: accelerated first year deduction for qualifying property, reducing upfront tax cost.

TL;DR

- Policy literacy plus depreciation timing drives TCO.

- Key incentives include bonus depreciation, Section 179, and policy clarity that improves budgeting and financing terms.

- Actions: map depreciation schedules, align with lenders on tax shields, test scenarios under policy changes, and weigh leasing versus buying for upfits and modernization.

What this means in practice is that policy literacy becomes the practical engine behind budgeting and decision making. When operators, finance teams, and lenders share a clear view of depreciation timelines and incentives they can forecast cash flows, time technology upgrades, and preserve margins even in policy flux.

Why policy literacy matters

Policy literacy matters because tax rules and depreciation cadence directly shape carry, cash flow, and risk. Clear understanding of the rules helps fleets plan purchases, financing terms, and upgrade cycles with confidence. It also strengthens the partnership between fleets and lenders by aligning expectations and reducing surprises when regulations shift.

How depreciation touches budgeting

Depreciation timing changes the cash flows fleets see in early years and affects the apparent cost of ownership more than sticker price alone. Incentives such as Section 179 expensing and bonus depreciation tilt the economics in favor of newer equipment or alternative powertrains. Policy certainty reduces budget risk by clarifying future tax treatment, which improves lender confidence and planning accuracy.

What this means for your planning

Lenders price risk around tax shields and depreciation expectations rather than sticker value alone. Fleets that map depreciation timelines, forecast tax benefits, and scenario test different policy outcomes can improve financing terms and flexibility. This throughline connects policy to practice in budgeting, capital planning, and equipment strategy.

Visual context

Transitional note to Insight

Insight

Takeaway The core idea is that tax policy and depreciation cadence shape fleet economics as much as the road does, guiding what fleets buy how they finance and how profits are protected. When lawmakers connect with industry partners through the Congressional Trucking Caucus the path to durable profitability becomes clearer. Policy literacy becomes a competitive asset in budgeting and growth.

Tax implications sit at the center of fleet financing decisions. Depreciation schedules alter the timing of cash flows and the apparent cost of ownership, which matters more than sticker price alone. Incentives such as bonus depreciation and expensing can tilt the economics in favor of newer vehicles or alternative powertrains. Policy signals bleed into lenders risk assessments by changing residual values and the expected tax savings. Operators learn to trade off upfront write offs against long term depreciation to protect margins.

- Accelerated depreciation speeds up tax relief in early years, improving financing spreads

- Bonus depreciation can lower first year cost of capital for eligible fleets

- Fuel and energy incentives influence choices toward efficiency or alternative propulsion

- Policy certainty reduces budget risk by clarifying future tax treatment

These forces help explain why fleets may prefer one vehicle segment over another and why some fleets move toward electrified options or advanced aerodynamics even when upfront costs are higher.

Policy signals also shape vehicle mix and lifecycle decisions. Fleets weigh initial cost against tax relief timing anticipated resale values and maintenance expectations.

- Tax credits and incentives can push fleets toward electrified or alternative fuel options

- Depreciation life and salvage values influence when to replace equipment

- Regulatory changes raise compliance costs that affect total cost of ownership

- Lenders price risk using the tax cash flow profile rather than sticker value alone

In planning budgets operators trace tax cash flows alongside fuel costs maintenance and financing payments to map a steady path through uncertainty. These fiscal rhythms help projects survive downturns and seize growth moments.

- Lenders model tax shields into debt service calculations

- Uncertainty about future rules increases hurdle rates

- Budgeting processes incorporate expected tax cash flows to smooth projections

- Treasury and tax compliance costs are factored into overhead estimates

Taken together these dynamics connect policy and performance. The Congressional Trucking Caucus serves as a forum to align legislative signals with industry realities, supporting trucking integrity safety and growth. Partnerships between fleets and financing providers enable more predictable expansion and resilience for the trucking economy. CDL drivers remain central to profitability through stable demand and effective financing.

This insight section bridges to the evidence section by showing why the data on depreciation incentives diesel prices and policy shifts matters for every fleet decision and every lender conversation.

Evidence data

Evidence matters when linking policy ideas to the road ahead. The trucking sector underpins both commerce and regional development. In 2024 America’s trucking industry generated nearly 906 billion dollars in revenue and supported about 8.4 million jobs, creating a backbone for supply chains across the nation.

Key data points ground policy discussions in credibility and demonstrate the scale of impact. The numbers are not abstract models; they reflect real fleets, real drivers, and real financing needs that shape budgets and business decisions at every level.

- Revenue: roughly 906 billion dollars in 2024

- Jobs supported: about 8.4 million

- Diesel price context: national and regional variations matter for budgeting

Diesel prices act as a central force in fleet economics. As of December 15, 2025 the national average for diesel stood at 3.61 dollars per gallon, a benchmark that operators use to test economics across routes and vehicle types. Regional variations matter too. The Rocky Mountain region recorded the largest price decline at 11.3 cents per gallon, while California remained the most expensive market at 4.78 dollars per gallon. The Gulf Coast region offered the cheapest diesel at 3.27 dollars per gallon, a spread that can influence equipment mix and route planning.

The data are echoed in the voices of industry leaders and policymakers alike. Generating nearly 906 billion in revenue in 2024, America’s trucking industry powers our economy by creating 8.4 million jobs and securing American supply chains. This sentiment aligns with the ongoing push to connect policy levers with real world outcomes.

Representative Dave Taylor: “I’m proud to launch the Congressional Trucking Caucus alongside my colleagues to create a forum for discussing policy solutions to keep all drivers safe on American roads, support hardworking truck drivers, and ensure the accessibility of reliable transportation across our Nation.”

Hyundai Capital America: “This partnership allows us to offer a seamless, customer-centric financing experience that aligns with our commitment to operational excellence.”

These voices sit alongside the work of associations and industry leaders named in the record. The Congressional Trucking Caucus champions dialogue on integrity, safety, and growth, while groups such as the American Trucking Associations, the Truckload Carriers Association, and the Owner-Operator Independent Drivers Association frame the policy discourse. Leading manufacturers and suppliers from the named entities like Hyundai Translead, Hyundai Capital America and the product line including Xcient fuel cell truck, dry and refrigerated van trailers, flatbeds, truck bodies and dollies remind readers that capital markets, equipment supply, and innovation all intersect in our fleets.

Together the data, the quotes, and the ongoing caucus dialogue ground the argument that tax policy yes matters for fleet economics yet policy certainty and collaboration between fleets and lenders are essential to preserve service levels, drive efficiency, and support a resilient trucking economy.

CDL drivers remain central to profitability through stable demand and effective financing.

The Three Pillars of Action

This section updates the narrative with three practical actions for readers to take as a result of the evidence. The emphasis is on clear steps and real world applicability rather than abstract theory.

Representative Dave Taylor: “I’m proud to launch the Congressional Trucking Caucus alongside my colleagues to create a forum for discussing policy solutions to keep all drivers safe on American roads, support hardworking truck drivers, and ensure the accessibility of reliable transportation across our Nation.”

Action steps

- Run scenario planning with finance and operations teams to forecast cash flows under multiple policy assumptions and depreciation timelines.

- Contact a lender with depreciation friendly terms to explore financing models that maximize tax shields and minimize upfront costs.

- Consult a tax professional to translate evolving rules into practical budgeting and reporting guidance.

- Quick tip: keep a central ledger linking asset cost, depreciation method, mileage, maintenance, and credits. This improves lender confidence and supports audits.

Visual Aid

Why this matters

A disciplined approach to depreciation planning improves budgeting, lender confidence, and equipment strategy. By aligning actions with policy signals and tax rules, fleets can accelerate modernization while preserving margins.

Sources and Footnotes

- IRS Publication 946 Depreciation and Amortization: https://www.irs.gov/publications/p946 [Updated 2024]

- IRS Bonus Depreciation guidance: https://www.irs.gov/businesses/small-businesses-for-credits-and-deductions/bonus-depreciation [Updated 2024]

- DOE EIA Diesel price data: https://www.eia.gov/energyexplained/diesel-price/ [Latest data cited 2025]

- Overdrive: Congress launches first ever trucking caucus: https://www.overdriveonline.com/regulations/article/15774387/congress-launches-firstever-trucking-caucus [Updated 2024]

- ATA and ATRI policy insights: https://trucking.org and https://atri.tech [Current as of 2024]

Payoff and Actionable Steps to Optimize Taxes on Commercial Vehicle Financing

A practical payoff for fleet managers is to translate tax policy into measurable cash flow and growth opportunities. By aligning financing decisions with depreciation rules and staying coordinated with policy conversations such as the Congressional Trucking Caucus, fleets can protect margins accelerate modernization and reduce risk. This payoff also ties directly to the broader trucking ecosystem and related keywords such as trucking integrity safety growth trucking economy Congress CDL drivers Hyundai Translead financing partnership diesel prices fuel prices Owner-Operator Independent Drivers Association American Trucking Associations Truckload Carriers Association trucking industry issues employment supply chains commercial fleets retail loans leases and the full set of related considerations.

- Depreciation choices

- Section 179: Choose to expense a portion of vehicle cost in the first year within applicable limits. This can reduce early tax liability and improve initial cash flow, especially for fleets purchasing multiple vehicles or upgrading to newer powertrains. Ensure eligibility based on vehicle use and tax rules for the year and verify current limits with your CPA.

- Bonus Depreciation: Leverage accelerated first year deductions for qualifying property when available. This can significantly lower upfront capital costs and improve financing spreads in the near term. Track asset class eligibility and any phase down or rule changes with your tax advisor.

- Leasing versus buying considerations

- Cash flow and budgeting: Leasing often lowers upfront cash requirements and keeps fleets flexible for technology upgrades, while buying builds equity and may unlock greater long term tax benefits through depreciation on owned assets. Assess mileage, maintenance costs, and expected lifecycle to determine which path supports your total cost of ownership.

- Residual risk and maintenance: Leasing typically shifts some risk to the lessor, but may include mileage limits and wear charges. Buying transfers residual risk to the fleet but allows full depreciation and potential resale value realization.

- Regulatory and powertrain strategy: If you anticipate policy changes or a shift toward electrified powertrains, leasing can offer a faster path to upfits and technology testing without tying capital to aging equipment.

- Tracking and record-keeping

- What to track: vehicle cost, acquisition date, depreciation method, mileage logs, maintenance spend, fuel costs, and any tax credits or incentives claimed. Maintain a centralized ledger for each asset.

- How to implement: use a digitized asset register that links to your general ledger, with reminders for annual depreciation reconciliation, mileage verification, and year end tax reporting. Clean, auditable records reduce risk during audits and improve lender confidence.

- Consulting a CPA and cross functional collaboration

- How to select a CPA: choose a practitioner with fleet financing experience and a track record of collaborating with lenders and operations teams. Seek a CPA who can translate policy shifts into actionable budgeting guidance.

- What to prepare: gather vehicle profiles, financing terms, depreciation schedules, and policy expectations from the Congressional Trucking Caucus; share updates with your finance, tax, and operations teams to maintain alignment.

- Quick capability payoff

- Build policy literacy alongside financing strategy to shift from reactive tax planning to proactive optimization. By integrating depreciation planning, sound leasing decisions, and meticulous record keeping with CPA guidance, fleets can improve after-tax cash flow, expand modern equipment, and support sustainable growth for the trucking economy.