Navigating the financial landscape can be complex for individual car buyers, auto dealerships, and small business fleet buyers. Understanding the relationship between Ally Auto Financial and Ally Bank is paramount for effectively leveraging their offerings. Although closely related under the corporate parent, Ally Financial Inc., these two entities serve distinctive functions that cater to specific needs. This article delves into their distinct roles, compares their product offerings, and explores the corporate structure that unites them, ensuring readers can make informed decisions in auto financing and banking.

Two Engines, One Umbrella: Auto Financing and Digital Banking in a Unified Financial Platform

A single corporate umbrella can shelter multiple engines, each tuned to a different rhythm of the financial world. In the case of a leading digital finance group, that umbrella houses two distinct yet closely intertwined entities: an auto-financing arm that moves people into vehicles and a fully digital consumer bank that moves money and credit through online channels. Viewed from the outside, these two arms might seem to operate in separate universes—one centered on vehicles, deals, and monthly payments; the other on savings, spending, and everyday banking. Yet they share a common purpose and a shared history, and together they form a cohesive engine that powers the company’s growth in a fast-changing financial landscape. The question the chapter explores is simple in phrasing but complex in practice: are these two operations the same entity at heart, or are they distinct branches with different goals and risk profiles? The answer lies in the ways they are structured, funded, and aligned to serve customers, regulators, and shareholders in a digital age where speed, efficiency, and transparency increasingly define value.

The roots of this arrangement stretch back in time, to an institution born to finance a growing industry—one that defined mobility and broadened the reach of everyday life. From its early iterations, the business evolved by blending loan capital and consumer financing with vendor and dealer support, learning to manage risk through disciplined underwriting and diversified funding sources. Over time, the umbrella broadened to include a fully digital banking successor, an institution that operates without the friction of physical branches yet offers the same core protections and consumer protections that have long defined modern retail banking. Where the auto-financing arm focuses on credit products tied to the vehicle itself—loans, leases, and dealer floor-plan financing—the digital bank expands the portfolio to everyday banking needs: deposit accounts, various forms of consumer credit, mortgage products, and investment services. The result is not two separate companies pretending to work together, but a deliberate architecture in which each arm strengthens the other while maintaining clearly defined boundaries. The arrangement is a practical response to how customers purchase, use, and ultimately finance their transportation and everyday money management in a digital era.

The automotive-financing component stands as the backbone of the group’s revenue engine. It is the area that has historically driven volume, depth of market, and relationships with dealerships across the country. In practical terms, this arm handles retail auto loans and leases for individual buyers and provides financing solutions to dealers, including inventory-related finance. It is a business built on long-standing industry ties, a deep understanding of automotive markets, and an appetite for managing cycles in a sector known for its periods of rapid change and seasonal demand. The core operations—auto lending and dealer financing—have continued to account for a substantial share of the company’s activity. As the landscape has evolved, this arm has broadened its reach beyond any single automaker, embracing a wider set of brands and dealer networks while maintaining a relentless focus on underwriting discipline, pricing economics, and a robust risk framework. The scale of this engine matters: when the auto-financing arm operates efficiently, it can generate steady volumes, support dealer networks, and sustain financing terms that attract buyers who are building or rebuilding credit across diverse segments of the market. The emphasis here is on closing loans, managing portfolios, and partnering with a network of dealers to ensure a smooth flow of credit through the supply chain.

The digital bank, by contrast, represents the foundation of the broader financial ecosystem. It is designed for customers who prefer a streamlined, online-first experience for everyday banking needs. This arm operates as a wide-ranging consumer bank—offering high-yield savings options, checking accounts, money-market accounts, and a suite of consumer credit products. It also extends into longer-term financing such as mortgages and, in many cases, other investment and wealth-management services. The defining feature of this arm is not the breadth alone but the economics of operation: a lean, branchless model, efficiently scaled by technology, that creates low-cost funding and high customer engagement through digital channels. This digital platform provides a stable liquidity base for the group while offering customers a seamless, accessible way to manage deposits, transfer funds, and interact with credit products across life stages. In practical terms, the bank’s funding model lowers the overall cost of capital for the entire group, which in turn can translate into more competitive terms for the auto-financing arm. The two segments thus form a feedback loop: the bank captures deposits and allocates capital to lending and other activities, while the auto arm generates revenue streams that support the bank’s balance sheet and resilience in uncertain times.

The relationship between these two pillars is more than financial. It is strategic, operational, and customer-centric. The bank’s digital orientation creates an environment in which data flows freely across the enterprise, enabling more precise risk assessment, underwriting insights, and customer service improvements that benefit both arms. Data-driven decision-making helps the auto-financing arm tailor loan terms to a broad spectrum of buyers, while the same insights improve the design of deposit products and credit offerings in the digital bank. The synergy manifests most clearly in how customers experience the brand’s ecosystem. A consumer who begins with a vehicle purchase or lease may complete financing steps quickly, comforted by a predictable financing structure and transparent terms. At the same time, that same consumer may choose to engage with the digital bank’s suite of everyday financial services, moving funds, growing savings, or financing home improvements with a personal loan or a mortgage—all within a single, connected experience. The goal is not to push customers into a single product or channel but to present a coherent, full-spectrum financial journey that leverages the strengths of both arms while preserving the clarity of each entity’s role. This approach is reflected in the governance model, risk policy, and product development process, where the umbrella’s leadership ensures that strategic choices respect the distinct product lifecycles and regulatory obligations of the two divisions while preserving a shared mission to empower customers to achieve their financial goals.

The two arms also differ in how they measure success and respond to market dynamics. The auto-financing division tends to weigh volumes, loan performance, and dealer relationships, with sensitivity to cyclical trends in vehicle demand, pricing competition, and macroeconomic factors that affect consumer credit. It relies on a networked distribution model—one that integrates with dealerships and the broader supply chain to maintain liquidity and access to inventory financing when needed. The digital bank, on the other hand, is measured by metrics that emphasize efficiency, cross-sell potential, digital engagement, and capital quality. Its strength lies in low-cost funding, scalable product lines, and the ability to serve millions of customers with a consistent, compliant experience across channels. The cross-pollination is where the architecture shines: deposits and liquidity enable broader lending capabilities; diversified lending activity supports a resilient business model that can weather shocks in any one segment. It is a practical embodiment of the modern financial enterprise, where a handful of well-integrated units operate with a shared vision but with specialized skill sets and processes tuned to their specific market realities.

From a customer perspective, the distinction between the two arms matters in tangible ways. When a buyer approaches the financing process, the focus is often on terms, speed, and certainty. The auto-financing arm uses underwriting models that combine traditional credit metrics with more contemporary data signals to assess risk and determine pricing, while coordinating with a dealer network to facilitate the sale and delivery process. The experience emphasizes clarity about payment schedules, residual values, and warranty or insurance considerations that can accompany vehicle ownership. In the digital bank’s world, customers come for everyday banking needs and stay for trust, convenience, and the ability to manage money with the tap of a finger. The platform is designed to minimize frictions—true digital self-service, prompt customer support, robust security, and dependable access to funds. The cross-functional benefits become apparent when customers learn that the bank’s funding and risk controls help sustain competitive loan terms for auto purchases, while the auto arm’s performance and data insights feed into the bank’s risk management and product development, creating a more resilient and responsive overall experience. This is not a tale of two brands competing for the same customer base; it is a narrative of two specialized engines that share capital, data, and a common purpose to deliver value through well-defined roles and disciplined management.

The strategic advantage of this architecture shows up in the company’s ability to adapt to volatility. In times of tighter credit markets, the digital bank’s funding efficiency and diversified product suite can help cushion the broader group, supporting stability and continuity of service. In periods of rising demand for vehicle ownership as confidence improves, the auto-financing arm can mobilize growth through dealer financing and consumer loans while benefiting from the bank’s stable funding base. The result is a calibrated balance sheet where each arm’s strengths reinforce the other, enabling the group to navigate cycles with greater confidence than a single-focus entity might achieve. The governance framework underpins this balance: clear separation of risk, capital allocation, and product development streams ensure that each arm maintains its own risk controls, while still enabling synergies that improve overall efficiency, pricing, and customer experience. In practice, this means that underwriting standards, pricing, and product terms are tailored to the specific risk profiles that matter to each arm, even as they draw on shared data, technologies, and strategic objectives that keep the entire enterprise aligned.

The question of whether these two operations are the same entity or distinct arms can feel academic until one considers the practical implications for customers and markets. The reality is simpler and more nuanced at once: they are distinct parts of a single family, with different purposes, governance, and capabilities, designed to work together in a way that strengthens the customer experience and the company’s resilience. This structure makes sense in a world where customers move fluidly between vehicles and everyday money management, where digital platforms redefine convenience, and where the best value emerges from the coupling of a low-cost funding model with disciplined lending. It is a model that recognizes the complexity of modern consumer finance, where the lines between products blur as people demand integrated, end-to-end financial solutions. The two arms do not operate in silos; they operate in concert, sharing data, calibrating risk, and aligning incentives to ensure that each contributes to the whole while preserving its own integrity and purpose. In that sense, the umbrella does not obscure the individual engines; it strengthens them by providing a unified strategic framework, robust risk management, and a scalable platform capable of supporting growth in an ever-evolving market.

For readers seeking a practical lens on vehicle ownership finances, consider the broader lessons of how two specialized arms can coordinate to deliver predictable, customer-centered outcomes in a digital age. The takeaway is not simply about whether two divisions share the same name but about how a well-structured corporate ecosystem can leverage its diverse capabilities to provide a smoother, more resilient experience for consumers who need both vehicle ownership solutions and everyday financial services. In this sense, the two pillars are not functionally identical nor interchangeable. They are complementary, each contributing a necessary piece to a larger puzzle: a comprehensive, digitally enabled financial platform that supports customers through the milestones of life—from buying a car to saving for the future—and does so with efficiency, clarity, and a relentless focus on the customer journey.

Two Brands, One Umbrella: Navigating the Distinct Roles of Ally Auto Financial and Ally Bank in a Unified Financial Ecosystem

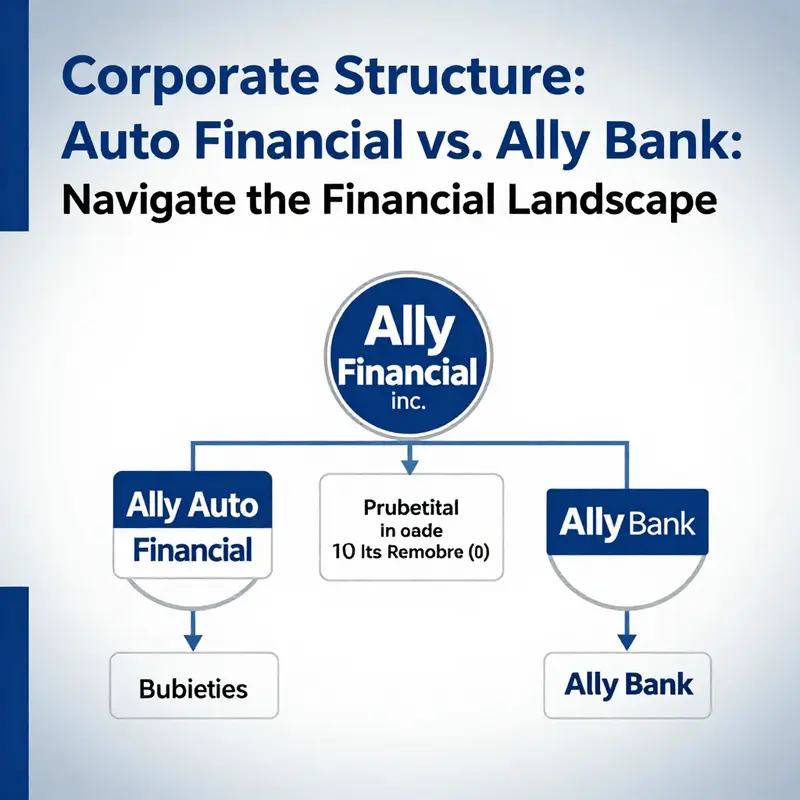

When people ask whether Ally Auto Financial and Ally Bank are the same, the answer requires more nuance than a simple yes or no. They are not the same company in the sense of being identical operations with a single consumer-facing product, yet they live under the same corporate umbrella, guided by a shared strategic vision and governed by the same parent organization. That arrangement—two specialized units under a single financial family—shapes how they operate, how they fund their activities, and how they interact with customers who may never realize they are engaging with two distinct engines behind a single brand. The history behind this structure helps explain why the two are described as closely related but functionally different. What began as a single institution with a long arc of evolution has split into specialized platforms designed to excel in their own lanes while cross-pollinating resources to strengthen the whole. This chapter traverses that landscape, weaving together the threads of focus, offering, customers, and digital strategy to illuminate how Ally Auto Financial and Ally Bank function as a coherent system rather than identical twins in a single market. In doing so, the chapter also clarifies what these distinctions mean for everyday consumers who are evaluating how to finance a vehicle, manage deposits, or pursue a path toward financial flexibility. For readers who want to connect the insights here to practical research, a broader knowledge hub that collects financial perspectives can be a helpful companion knowledge hub. The two units share a common DNA, but their day-to-day operations, risk profiles, and product architectures reflect deliberate choice about where they excel and whom they serve. The longer arc of Ally Financial—from its roots in a famous American automaker’s financing arm to a diversified, digital-first financial services company—provides a useful frame for understanding why the architecture was designed as it is today. The parent company manages resources, governance, and brand stewardship while allowing specialized divisions to cultivate deep expertise in their respective markets. The synergy is not accidental. It rests on a dual premise: deep, durable expertise in a particular corner of the financial services universe and a scalable, data-driven platform that can allocate capital and capabilities where they drive the most value. The result is a financial ecosystem that can respond to shifting consumer expectations without sacrificing the efficiency and reliability that come from specialization. Ally Auto Financial has grown into the anchor of automotive finance—an area characterized by extensive dealer networks, complex funding needs, and nuanced risk management tailored to vehicles’ life cycles. Its core competencies lie in structuring deals for both individual buyers and dealership operations, creating a continuum of financing options that align incentives across the ecosystem of vehicle acquisition, ownership, and exit. Ally Bank, by contrast, has emerged as the repository of the company’s retail funding and digital banking capabilities. It builds consumer trust by offering accessible, user-centered banking experiences that emphasize ease of use, safety, and transparency. The bank’s deposit base, digital interface, and broad suite of savings and investment products form the stable funding backbone that supports the lending activities spread across the Ally Auto Financial platform, as well as other lending channels. Understanding this division of labor helps demystify what can appear as a single brand with a single logic to an observer who does not see the underlying architecture. In practice, the two units operate with shared governance, shared brand identity, and shared data infrastructure, but they execute with a disciplined focus that matches their distinct markets and customer journeys. The automotive financing function requires a emphasis on vehicle values, residuals, floor planning, and dealership liquidity. It is a business built on long-standing relationships with dealers who stock inventory and rely on timely funding to move vehicles from lot to customer. The ability to offer competitive terms, flexible structures, and robust risk controls is critical because the collateral—vehicles—has a value that can fluctuate with used-car markets, borrower’s credit profile, and macroeconomic conditions. The dealer channel adds another layer of complexity. Financing a dealership requires wholesale lines of credit, scheduling, and servicing arrangements that ensure a smooth flow of inventory. The consumer-facing elements must be intuitive and transparent, because buyers need to understand payment terms, residuals on leases, and the long-term cost of ownership. In this environment, Ally Auto Financial positions itself as a partner to the consumer and to the dealer, offering financing pathways that can move from the showroom floor to the service bay to the driveway. Meanwhile, Ally Bank operates in the broader consumer financial services space, where the emphasis shifts to deposits, digital account management, and a broad spectrum of financial products designed to meet everyday needs and long-term planning. The bank’s digital-first approach—no physical branches in the traditional sense—creates a different rhythm of customer interaction. It requires a frictionless onboarding process, robust security protocols, and a suite of tools that help customers grow their savings, manage expenses, and explore investments. The separation of these functions within a single corporate umbrella is not a cosmetic choice but a strategic design. It enables the company to tailor its risk appetite, funding strategy, and product development process to the unique economics of each line. The automotive financing arm benefits from a continuous loop with dealership networks, using extensive data to price deals, forecast demand, and optimize inventory financing. The banking arm benefits from a stable, low-cost funding base sourced from deposits that can be deployed across the broader lending portfolio, including autos and mortgages. This funding dynamic—where deposits provide the capital for lending—creates a virtuous circle that underpins the entire enterprise. The digital platforms themselves are more alike than they are different in spirit: both prioritizing a streamlined customer experience, real-time data processing, and scalable technology stacks. Yet the customer journeys diverge in meaningful ways. A consumer seeking a vehicle loan typically interacts with a finance portal that accelerates approval, clarifies terms, and integrates with dealer processes. The same consumer, if they want everyday banking services, is drawn to a separate digital experience designed for routine tasks: account management, transfers, bill payments, and the growth of savings or investment plans. The alignment between these journeys is where the value proposition becomes clear. The best consumer experiences often feel seamless, even when they are powered by distinct platforms. That seamlessness is the product of a shared design language, consistent security standards, and a unified commitment to responsible lending and prudent financial stewardship. The strategic role of each unit within Ally Financial’s ecosystem is thus complementary rather than duplicative. Ally Auto Financial anchors the company’s position in a highly competitive market by leveraging its decades of experience, a broad and mature dealer network, and the ability to structure lucrative, scalable financing arrangements for vehicles. Its strength lies in the speed and precision with which it can fund, manage, and service automotive credit and lease portfolios. Ally Bank, on the other hand, fortifies the company’s long-term resilience with durable, customer-sourced funding and a digital platform that makes everyday financial life easier. Deposits, CDs, and investment options provide a steady revenue base and funding stability that can support the variability of auto and mortgage lending cycles. The dual structure also fosters a broader brand narrative: a single, trusted label that signals reliability across the spectrum of consumer finance, while acknowledging that different customer needs require distinct capabilities. Consumers may interact with elements of both platforms, often without recognizing the division of labor that makes such interactions possible. A customer who finances a vehicle may also consider saving or investing through a digital broker platform linked to the parent brand, or they may explore a mortgage through a related unit. The practical reality is that cross-pollination happens at the data and operations level, not necessarily in the consumer’s line of sight. Digital-first principles are central to both sides of the house. On Ally Auto Financial’s side, customers expect a transparent process from application to funding, with clear disclosures, streamlined documentation, and ongoing loan servicing that makes payments straightforward and predictable. On Ally Bank’s side, customers expect a modern online banking experience—instant access to funds, real-time alerts, and a robust ecosystem of deposit products and investment tools. The shared digital backbone helps this alliance thrive. It allows the enterprise to deploy capital efficiently, optimize risk management, and maintain a cohesive brand experience even as the customer touches two different product ecosystems. Beyond the mechanics of funding and customer journeys lies the broader industry context. As consumer expectations have evolved toward digital convenience, financial institutions of all stripes have learned to emphasize transparency, speed, and reliability. For the two Ally platforms, the challenge is to keep pace with rapid technological change while preserving prudent governance and regulatory compliance. This means investing in data analytics to drive pricing, credit decisions, and risk controls, while ensuring that the customer experience remains intuitive and secure. In practice, this careful balance translates into the ability to offer competitive terms for automotive financing without compromising the safety and soundness of the broader balance sheet. It translates into a deposit-driven funding model that keeps costs down and responsiveness high, even when markets experience volatility. It also translates into a brand story that emphasizes accessibility, digital convenience, and an enduring commitment to customers across stages of life—from first car purchases to longer-term wealth-building goals. While the two units have distinct value propositions, their success depends on a shared culture of accountability and a disciplined approach to portfolio management. The leadership philosophy that unites them emphasizes disciplined experimentation, data-driven decision-making, and a customer-centric focus that prioritizes clarity and trust. From the consumer’s perspective, the important takeaway is pragmatic rather than philosophical: understand where a product lives within the ecosystem, what the underlying funding and risk implications are, and how the experience remains coherent as you move from a vehicle purchase to everyday banking and, potentially, long-range financial planning. Misconceptions can arise when observers focus on the surface-level branding rather than the structural design. The same brand can signal a consistent customer experience while concealing the fact that two specialized platforms are delivering different services through different channels and with different regulatory considerations. Recognizing this distinction helps consumers avoid confusion and makes it easier to make informed choices about how or where to engage with the Ally family. The broader implication for the financial landscape is that big, diversified families can offer robust customer experiences by blending specialization with scale. The automotive finance arm can chase niche efficiency, while the digital bank can provide the durable funding framework that supports broader lending activity. The result is a resilient, adaptable ecosystem capable of meeting evolving consumer needs without sacrificing governance, risk discipline, or operational excellence. As markets shift and consumer preferences crystallize around digital products and quick, transparent financing, the Ally model offers a template for how to balance specialization with integration. The two platforms do not merely co-exist; they reinforce one another in ways that become evident only when viewed through the lens of the entire enterprise. For readers who want to trace this logic to a broader source of record, the corporate site provides the official articulation of the company’s strategy and structure: https://www.ally.com. Understanding the nuanced relationship between Ally Auto Financial and Ally Bank helps demystify a common question and clarifies why the two units, while separate in function, share a single mission: to deliver dependable financial solutions that adapt to where customers are in their financial journey. The journey from vehicle financing to everyday banking and into long-term wealth management is not a straight line but a connected continuum, and the Ally ecosystem is built to navigate that continuum with purpose and clarity. The practical takeaway for researchers, students, and professionals is that organizational design matters as much as product design. When a company chooses to cultivate deep, specialized capabilities within a unified brand, it creates a platform where knowledge, capital, and customer trust flow more efficiently across boundaries. The result is not merely a portfolio of services but a coherent strategy that can endure changes in consumer behavior, interest rates, and regulatory landscapes. In this sense, the question of whether Ally Auto Financial and Ally Bank are the same becomes less about sameness and more about alignment. They are distinct, yes, but aligned—pursuing complementary objectives within a framework that prizes efficiency, transparency, and customer empowerment. In the end, this alignment serves buyers and savers alike, offering a smarter, more connected way to experience finance in a digital age. External reference: https://www.ally.com

Under One Umbrella, Distinct Wings: Navigating Ally Financial’s Automotive Financing and Digital Banking Structure

The question of whether Ally Auto Financial and Ally Bank are the same entity cuts straight to the heart of how modern financial groups organize themselves. In practice, a single corporate umbrella can house multiple operating arms, each with its own regulatory footprint, customer focus, and risk profile. What appears as a single brand to the public is often a carefully segmented architecture inside the corporate walls. The automotive-finance arm and the consumer-banking platform are not the same entity in legal terms, but they are nonetheless intimately connected through a shared parent, common governance, and a strategic plan that seeks to create a cohesive financial ecosystem for customers. Understanding that distinction—between separate legal entities and a unified strategic system—helps explain why the group can offer a broad spectrum of services while maintaining clear lines of responsibility and accountability for each business line. In many large financial organizations, the synergy lies not in merging every function into one unit, but in weaving technology, data, and capital across specialized subsidiaries that together form a robust, digital-first enterprise.

If one peels back the surface, the parent company emerges as a global digital financial services firm headquartered in Detroit. Its corporate footprint extends across multiple subsidiaries and business units that support a wide array of financial products and services, ranging from consumer deposits and loans to vehicle financing and insurance products, to residential mortgages and other forms of credit. This structure matters because it describes how the company manages risk, allocates capital, and steers product development across very different markets. The public understanding of the brand often conflates these components, but the legal and organizational boundaries are real. The parent acts as the central governor, aligning strategy, technology platforms, and risk management practices while enabling the distinct subsidiaries to operate with a degree of autonomy that is essential for meeting specific market demands and regulatory requirements.

A useful way to map this arrangement is to think of two core operational engines that share a common engine room. The first engine runs the automotive-finance operations. It is responsible for consumer auto loans and leases, dealer financing, and vehicle-related credit facilities that enable the purchase or lease of cars through a network of dealerships. This engine also interacts with the broader ecosystem of floorplanning and receivables management, ensuring that the flow of credit, the disposition of assets, and the financing arrangements around the sale of vehicles are supported by a disciplined financial framework. The second engine operates as the consumer banking platform, delivering deposit accounts, digital payment capabilities, and a full suite of lending products that span personal loans, mortgages, and related banking services. While these two engines rely on shared technology and data resources, their customer segments, regulatory regimes, and revenue models differ markedly. The automotive-finance arm is deeply entwined with the vehicle ecosystem—the lending, leasing, dealer relationships, and asset-backed financing—whereas the banking platform centers on consumer deposits, payments, and general-purpose lending that is tied to consumer financial health over time.

At a macro level, the corporate structure reveals four principal business segments that support the broad portfolio of offerings under the umbrella. The automotive-finance segment forms a core revenue and asset-management engine, providing consumers with installment financing options, lease structures, and floorplan financing that underwrites auto dealerships’ inventory and operations. This segment, by its nature, is closely tied to the automotive retail environment, with revenue anchored in interest income, fee arrangements, and the management of credit risk associated with automotive portfolios. The insurance segment sits in the mix as a distribution channel for consumer protection products and warranty offerings—products that are commonly bundled with vehicle purchases or offered through the dealer network. This part of the organization complements the automotive-finance function by providing a way to mitigate risk for customers and for the financing base, while also creating additional revenue streams across dealer channels.

The mortgage banking segment expands the enterprise’s reach into the housing finance market, delivering residential mortgage loans and related services. This segment reflects the company’s strategic emphasis on diversified lending and the ability to leverage its digital capabilities to reach a broad customer base seeking long-term borrowing and homeownership solutions. The fourth segment, described as the “Other” category, aggregates internal management and technology development. This catch-all is essential in a digital-first institution because it houses the core platforms, data analytics capabilities, risk-management infrastructure, and governance processes that enable the other segments to operate efficiently at scale. Taken together, these segments illustrate how a single corporate group can shepherd a variety of financial activities—each with its own regulatory and market dynamics—through a unified strategic framework.

Delineating the key subsidiaries helps illuminate how the parent company executes its strategy in practice. One subsidiary functions as the core retail banking platform, delivering everyday banking products and consumer credit offerings in a highly digital, customer-centric way. A separate unit focuses on automotive-originating operations, channeling credit through a network of dealers and supporting the lifecycle of vehicle ownership with financing and leasing options. Alongside these are entities dedicated to asset management and receivables, which handle the financial assets and investment-grade credit portfolios that underpin the group’s balance sheet. A holding entity exists to oversee governance, risk oversight, and the allocation of capital among the various business lines. Although the precise legal names of these entities are specific to regulatory and jurisdictional requirements, the architectural principle remains constant: distinct legal entities, each with a defined mission, under a single corporate umbrella bound by a common governance framework and a shared digital platform strategy.

This architecture is more than a bookkeeping exercise. It shapes how customers experience the brand, how the company manages risk, and how it invests in technology that can serve multiple purposes across segments. For customers, the clarity of two distinct interfaces—one for vehicle-related financing and one for general banking products—helps set expectations about who handles what part of the financial relationship. For regulators, the separation supports transparent supervision of different product lines, their capital requirements, and the risk profiles they carry. For the company, the separation enables specialized risk management, targeted product development, and flexible capital allocation that can respond to changing market conditions without compromising the integrity of the entire enterprise. In such a setup, the phrase “one company, many operations” takes on a concrete meaning: there is a unified brand and shared capabilities, but the day-to-day operations, customer journeys, and risk controls are distinctly aligned with the needs and regulatory realities of each business line.

When we consider the customer experience across these wings, the differences become clearer without losing the sense of a common mission. The automotive-finance engine has to navigate the realities of auto cycles, dealer relationships, and vehicle depreciation risk. It must balance competitive financing with portfolio quality, while maintaining strong relationships with dealer networks that are integral to the customer journey from showroom to financing approval to delivery. The consumer-banking platform, by contrast, emphasizes digital access, liquidity options, and a broad suite of deposit and lending capabilities that address everyday money management and longer-term financial goals. It must deliver secure, scalable digital experiences, integrate payments and savings functionality, and provide consumer credit that aligns with the broader lifecycle of household finances. In both cases, the shared technology backbone—data platforms, identity and authentication systems, regulatory reporting, and fraud prevention tools—creates efficiencies that are difficult to achieve with wholly separate organizations. The goal is not to merge every function into a single monolith, but to provide a nimble, integrated environment where different lines of business can operate with precision while benefiting from economies of scale and shared, safety-net-like risk controls.

An important aspect of this structure is how governance works across the enterprise. The parent company maintains oversight through a centralized board of directors and established risk-management committees, ensuring consistent capital allocation, strategic alignment, and compliance across all business segments. This governance model supports the ability to fund strategic technology initiatives, which in turn enhances the customer experience, speeds up product development, and strengthens the resilience of the entire portfolio. Because the automotive and banking activities demand different kinds of expertise, governance emphasizes appropriate separation of duties, clear accountability lines, and robust internal controls. Yet governance is not a hollow abstraction; it translates into practical outcomes in the form of transparent financial reporting, standardized risk metrics, and consistent treatment of customers across channels. The structure is designed to be resilient in the face of economic shifts—whether the automotive market cools, interest-rate environments change, or housing markets experience turbulence—by ensuring that each segment can respond without jeopardizing others.

From a consumer perspective, the distinction between the automotive-finance operation and the consumer-banking platform often translates into a clearer sense of responsibility when questions arise about a loan, a lease, a deposit product, or a mortgage. The consumer will typically interact with the business lines through different channels, yet the relationships may be connected through the broader brand. The customer who finances a vehicle may also hold deposit accounts or a mortgage with the same corporate family, and while the two services may be accessed through separate applications or online experiences, their backend systems are designed to share information responsibly to support a cohesive financial profile. This is increasingly important in a digital world where customers expect a seamless experience across devices and touchpoints. The reality, however, is that each line operates within its own regulatory perimeter and adheres to its own risk appetites, capital requirements, and product development cycles. The effect, in practice, is that a user-facing identity can be consistent, even as the underlying entities remain distinct.

For those who want to trace the corporate map beyond the simple two-to-one relationship, a review of the subsidiary layer reveals a more nuanced picture. A primary subsidiary serves as the core retail banking arm, providing deposit-taking capabilities and access to a wide range of consumer credit products. A separate subsidiary handles automotive financing, focusing on the lifecycle of vehicle ownership, dealer relationships, and the management of vehicle-related assets. A financing-portfolio management entity oversees the receivables portfolio and asset-backed activities that underpin liquidity and capital management, while a holding company provides structural coherence for the entire group and coordinates cross-entity initiatives. This combination—connected by governance, shared platforms, and interdependent capital dynamics—explains how the brand can maintain a unified identity while delivering specialized financial services that meet distinct customer needs. It also helps explain why the two arms are not the same entity, despite their shared lineage and the way they reinforce one another in the marketplace.

Within this framework, the broader ecosystem of offerings and capabilities helps to illustrate a central truth about modern financial groups. The same corporate umbrella can host multiple, legally distinct entities, each with tailored risk, product, and service configurations. This design enables a bank to participate actively in consumer banking while also engaging vigorously in automotive financing and related insurance and mortgage activities. It supports cross-sell opportunities—offering customers the chance to move smoothly from a vehicle purchase to a home-buying journey or to consolidate financial services for convenience—without blurring the lines of regulatory responsibility or diluting the risk controls that protect both customers and the institution. In this sense, the structure is not an impediment but a strategic asset. It allows the company to respond to evolving customer expectations, to deploy technology updates that serve multiple purposes, and to allocate capital to areas of greatest strategic importance while maintaining disciplined governance.

For readers who want to explore the governance and corporate structure in more detail, the broader context and official framing from the parent company provide essential background. The enterprise emphasizes its global digital approach, the scale of its asset and liability management, and its commitment to serving customers through a spectrum of financial services within a carefully managed, risk-conscious framework. In practice, this translates into an architecture where two distinct operating lines—one anchored in the vehicle-financing ecosystem and the other anchored in daily banking and long-term lending—are bound together by a shared mission to deliver accessible, trusted, and innovative financial solutions. This mission is reinforced by technology platforms designed to support rapid product iteration, robust data privacy and security controls, and a culture of compliance that seeks to anticipate and adapt to changing regulatory landscapes. The result is a coherent enterprise that remains legible to customers and investors alike, even as it navigates the complexities of operating in multiple financial domains under a single umbrella.

In sum, Ally Auto Financial and Ally Bank are not the same entity, but they are closely related and strategically coordinated within the same corporate family. The automotive-finance arm and the consumer-banking subsidiary each carry their own governance structures, regulatory considerations, and performance metrics. Yet they benefit from shared technology, risk-management discipline, and strategic capital allocation that enable them to align on a common set of goals while preserving the autonomy needed to excel in their respective markets. This arrangement clarifies why the two arms can appear under the same brand, share a digital backbone, and still function as distinct legal entities. It is a model that mirrors the evolving reality of modern finance—a model that prioritizes specialized expertise, transparent governance, and a customer-centric approach across multiple financial domains, all under one corporate roof. For readers who want to delve deeper into the organizational dynamics, a concise overview of the knowledge resources available on the subject can be found here: Davis Financial Advisors knowledge hub.

External reference for broader context and verification:

External resource: https://www.ally.com/about-us/our-companies/

Final thoughts

Understanding the nuances between Ally Auto Financial and Ally Bank is essential for auto buyers, dealerships, and fleet buyers. Each entity, while under the same corporate umbrella, serves unique needs in auto financing and banking. The insights provided in this article empower readers to better navigate their options, ensuring they leverage the right services at the right time. Whether seeking an auto loan or banking services, recognizing the distinct offerings of each can significantly enhance financial decisions.