The Auto Financial Responsibility Law plays a critical role in the automotive landscape, influencing both individual car buyers and businesses alike. This law ensures that vehicle owners can financially manage the responsibilities that arise from accidents, thus supporting accountability and victim compensation. In this comprehensive guide, we explore the significance of this law and how it affects various stakeholders. From understanding the minimum insurance requirements to exploring alternative proofs of financial responsibility, we will delve into the implications of non-compliance and how the law promotes safer driving habits. Each chapter will provide specific insights tailored to individual car buyers, auto dealerships, small business fleet buyers, and industry stakeholders, enabling you to navigate these legal requirements with confidence.

Weaving Accountability into the Road: The Essential Role of Auto Financial Responsibility Law

Auto Financial Responsibility Laws (FRL) are not mere paperwork. They are a deliberate architecture that binds driving to accountability. At their heart, FRLs require drivers to demonstrate they can pay for the costs of injuries and property damage they cause in a crash. This linkage matters because accidents impose costs on victims, health systems, and communities, even when negligence is involved. By making financial responsibility a prerequisite to driving, FRLs create a risk gradient: drivers who cannot cover the consequences are steered toward not getting behind the wheel, or at least toward safer, more careful behavior. The practical result is a system that nudges people toward carrying appropriate protection and being prepared to contribute to the costs of harm when it occurs. For victims, the FRL facilitates access to compensation rather than a vacuum of liability that leaves them paying out of pocket. For society, it reduces the likelihood that uninsured losses will be absorbed by public resources or charitable funds. The policy logic blends consumer protection with public safety, acknowledging that the costs of crashes extend beyond the moment of impact. It also recognizes that medical bills, repair costs, and time away from work create a financial ripple that can deter recovery and exacerbate hardship if no one is obliged to bear them. The framework, therefore, operates as a shield for those harmed and a reminder that driving is a privilege conditioned on accountability.

Almost every state seeks to achieve this objective through a liability insurance requirement. The phrase “minimum coverage” is not an empty slogan but a set of thresholds tied to how much a family or business can absorb after a crash. In practice, what counts is insurance that pays for injuries to others and for property damage caused by the insured driver. The limits that states set reflect a calculus of medical costs, vehicle repair, and the broader risk landscape of their communities. Because the scope of coverage matters, states often publish standard forms and provide consumer-friendly summaries to help drivers compare options. The essential takeaway is that the FRL uses a concrete financial metric—proof of insurance or an accepted alternative—to determine whether a driver’s financial means align with the potential consequences of their actions. In addition to basic liability insurance, some states permit supplementary forms of financial responsibility. An umbrella policy, a surety bond, a cash deposit, or even self-insurance under certain conditions can fulfill the same requirement. The Ohio example demonstrates how state variation translates into real differences in how people meet the law’s demands, while still aiming for the same end: a credible guarantee that victims receive compensation when harm occurs. This mosaic of policy choices captures how FRLs balance consumer protection with practical mobility needs across a diverse national landscape.

Compliance is designed to be verifiable without turning every routine car ride into a bureaucratic ordeal. Common mechanisms include proof of insurance at registration, periodic verification by the DMV, and cross-checks against insurance databases. Some jurisdictions go further, requiring drivers to carry a cash deposit or a surety bond or to demonstrate enough net worth to support self-insurance when warranted by driving history or risk factors. These approaches balance the need for enforceable standards with the practical realities of how people obtain and maintain coverage. The net effect is a system in which the possibility of compliance is clear in advance, while the penalties for non-compliance send a message about the seriousness of the obligation. The Ohio rule cited earlier gives a concrete sense of how a state might translate the general principle into a measurable obligation. The law’s broader aim, however, remains constant: to ensure that accident costs do not diffuse into a social safety net that lacks accountability or to the detriment of victims seeking timely compensation. A well-designed FRL thus reduces uncertainty in post-crash outcomes and supports a smoother, more predictable process for everyone involved.

Penalties for failing to maintain financial responsibility are not abstract sanctions; they are mechanisms for preserving trust in the system. License suspensions, registration denial, fines, and mandatory court appearances are typical consequences, but many states tailor sanctions to the driver’s history and the severity of non-compliance. The penalties are designed to deter neglect and to ensure that the right to drive remains conditioned on an ability to answer for harm. In practice, this means that a driver who loses insurance coverage may lose the privilege of operating a vehicle until they restore coverage and resolve outstanding obligations. These rules, while potentially disruptive, serve the broader public interest by limiting the number of uninsured motorists on the road and by reinforcing a clear chain of accountability from the moment a policy lapses to the moment a claim is paid. The FRL thus acts as both a shield for victims and a framework that encourages prudent, responsible behavior on the road. The policy design acknowledges trade-offs—mobility versus protection—and seeks to minimize harm by ensuring that the costs of accidents are borne by those who have the capacity to address them.

Beyond the immediate mechanics of coverage, FRLs influence the economics of driving in our communities. They translate risk into a tangible obligation that is traceable through records, claims, and the licensing process. This tangible link between driving and responsibility encourages insurers to price risk appropriately and motivates consumers to choose coverage that reflects their actual exposure. At the same time, FRLs recognize that not all drivers have the same capacity to pay or obtain insurance, and they allow for alternatives designed to preserve mobility while ensuring accountability. These considerations matter when analyzing equity and access to safe transportation. When a crash happens, victims deserve more than moral support—they deserve a viable route to compensation that can fund medical care, property repairs, and the ordinary costs of living disrupted by injury or loss. In that sense, FRLs reduce the risk that harm becomes a permanent financial burden carried by strangers rather than the person who caused the harm. The framework also tends to influence driver behavior, encouraging safer choices, discouraging risky practices, and highlighting the responsibility that comes with the privilege of operating a vehicle. The economic dimension of FRLs thus reinforces a social contract—one that links the right to mobility with the obligation to respond to harm in a manner that supports victims and sustains public resources.

Enforcement remains a live part of the FRL’s effectiveness, evolving with technology and with the dynamics of modern mobility. States use a mix of administrative checks, post-accident verifications, and targeted enforcement aimed at recurrent violators. The practical image is a system that rewards compliance without turning routine registration into an obstacle course, while making it clear that non-compliance has consequences that affect one’s ability to drive. To help readers navigate this landscape, a concise resource hub offers practical guidance on how to verify coverage, renew policies, and understand notice requirements; see the internal link here: davisfinancialadvisors.net/knowledge/. As the regulatory environment shifts—whether through evolving insurance markets, data-driven enforcement, or potential reforms—FRLs continue to be a touchstone for balancing individual mobility with the needs of injured parties and the broader public purse. For a deeper dive into the legal mechanics and state-by-state variations, external experts provide broader context about how these laws function in practice: https://www.irmi.com/insurance-terms/f/financial-responsibility-law/.

Guardrails of Responsibility: Decoding Minimum Auto Insurance under the Financial Responsibility Law

When a driver steps behind the wheel, the road carries not only the risk of collision but also a deliberate architecture of accountability. The Auto Financial Responsibility Law forms a core part of that architecture in most U.S. states. Its essence is straightforward in principle: every vehicle owner must demonstrate the financial capacity to pay for damages resulting from an accident. Yet the practical expression of that principle is intricate. It translates into minimum liability limits, variances by state, and sometimes alternative methods of proving responsibility, all designed to protect victims while preserving the integrity of public resources. The legal standard is not a single universal number but a framework that states adapt to their own economic realities and policy priorities. What binds these diverse approaches is a shared belief that driving should not leave victims unpaid and that institutions should not bear the burden of paying for someone else’s mistakes out of emergency funds or public coffers. In this sense, minimum auto insurance requirements are less about mandating a specific price of coverage and more about guaranteeing a floor of financial accountability that accompanies every vehicle on the road.

The practical effect of the FRL is to shift risk away from injured parties and toward a structured, market-based solution. Insurance is the most common instrument used to satisfy the law, because it offers a reliable channel for compensating bodily injuries and property damage. It also distributes the cost of accidents across a broad pool, moderating the price spikes that can occur when a single event leaves one party financially stranded. However, it is important to remember that the minimums are not just a budget line item; they are a legal covenant. They create a baseline that helps victims access funds quickly and reduces the likelihood that public resources must subsidize losses that arise from auto crashes. The law’s protective intent is thus twofold: to secure compensation for those harmed and to deter negligence by making drivers consider the cost of careless driving in a tangible, enforceable way. The result is a system that prizes predictability and accountability as the cornerstones of road safety.

State by state, the mechanics of compliance look similar on the surface, but the numbers and accepted formats tell a nuanced story. The common structure includes three elements: bodily injury liability per person, bodily injury liability per accident (which essentially aggregates the per-person liability to reflect multiple injuries in a single crash), and property damage liability. From these categories, most states derive a practical minimum that balances affordability with the likelihood of covering substantial costs arising from a collision. A widely cited configuration in many jurisdictions is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage. These figures have become a rough baseline because they reflect a reasonable expectation of medical expenses and vehicle repair costs in many incidents. Yet, the alphabet of state rules includes nonuniform letters: Florida’s minimums, for example, are notably lower, while states such as California push toward higher limits to respond to higher average costs. The consequence is clear for anyone who travels or contemplates relocation: the bare minimum in one state may be insufficient protection if a driver encounters a different regime or a larger claim framework in another state. In day-to-day terms, that means prudent drivers do not only subscribe to a policy that meets their state’s minimums; they assess how their coverage stands up as they move through different legal environments, why a single state’s threshold may be too low for a broader life on the road, and how this consideration interacts with their household finances and risk tolerance. For a broad perspective on the landscape, a reader can explore the regulatory backdrop through the national bodies that monitor these shifts and publish state-specific details.

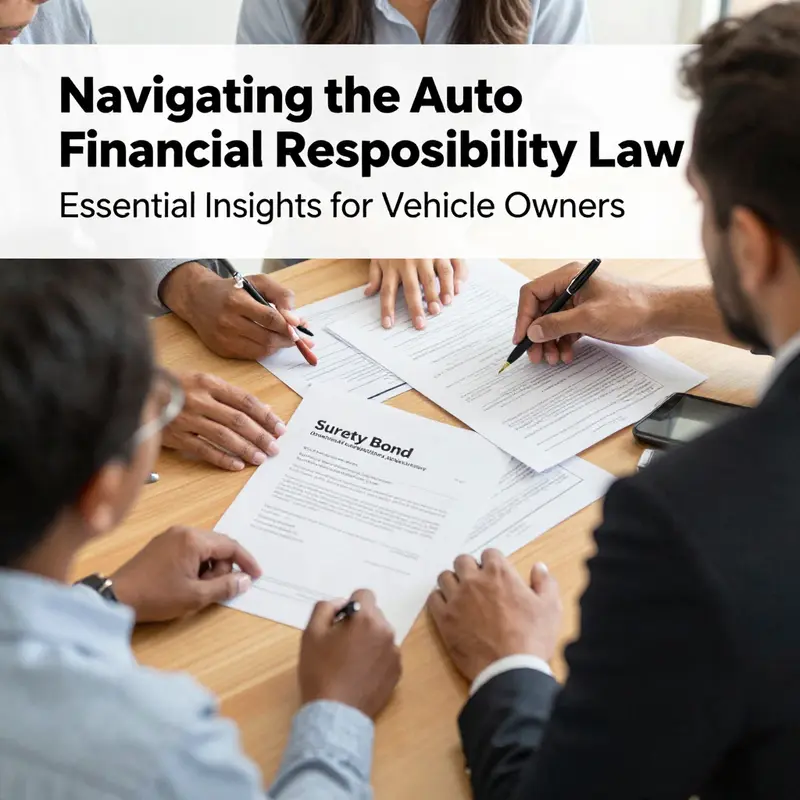

Beyond the standard insurance policy, some states provide alternative pathways to satisfy financial responsibility. A surety bond or a cash deposit with the state can substitute for traditional coverage in certain circumstances. These options recognize that not every driver participates in the same insurance market or has easy access to standard policies, and they offer a legally acceptable route to demonstrate responsibility. Still, in everyday practice, traditional insurance remains the preferred method for most drivers. Insurance is more than a contract; it is a risk-sharing mechanism that can adapt to a wide range of accident outcomes. It covers medical expenses, rehabilitation, lost income, and property damage in a manner that a bond or cash deposit cannot as comprehensively address. The choice between an insurance policy and an alternative form of financial responsibility is not merely about legality; it is about actively shaping one’s readiness to recover from the financial shock of a crash and about the speed with which a family can regain stability after an incident. The decision carries long-term implications for monthly costs, debt levels, and the mental bandwidth required to navigate the aftermath of an accident.

The rationale behind setting minimums is as pragmatic as it is protective. First, the framework aims to ensure that accident victims are not left without recourse. In the wake of a crash, the injured party deserves a prompt path to compensation for medical bills, rehabilitation, and other losses. Second, the framework helps preserve public safety and public finances by reducing the likelihood that an accident will devolve into a broader societal emergency, where hospitals, social services, and local governments bear the brunt of uncompensated costs. Enforcement is layered rather than punitive: many states implement periodic checks, post-accident verifications, and license or registration actions to ensure ongoing compliance. These measures serve as steady signals that the law is real and enforceable, rather than a theoretical standard. The balance struck by most FRLs is a careful one—enough protection to support victims and maintain system integrity, while preserving the ability of responsible drivers to manage the cost and complexity of coverage. When the elements align, the law supports safer driving by aligning personal responsibility with collective welfare.

For a reader aiming to map the exact requirements, the path unfolds through official state channels. The best starting point is the state’s Department of Motor Vehicles, often the repository of the precise minimums, plus any accepted alternatives to traditional insurance. In some states, regulatory agencies publish consolidated guidance that clarifies whether a surety bond or a cash deposit can substitute for a policy and specifies the required forms and timelines for compliance. Because the thresholds shift over time and can vary with legislative change, a routine check before policy renewals or license renewals is a sensible practice. In addition to these state sources, there is a national reference point that helps readers understand how states compare and how the regulatory landscape evolves. The National Association of Insurance Commissioners offers comprehensive, up-to-date data and explains the rules in accessible terms. While this chapter has focused on the core concept of minimums, readers should confirm the current thresholds in their jurisdiction, especially if they plan to travel or relocate. For a broader overview of related financial topics connected to transportation and risk, see the knowledge hub at davisfinancialadvisors.net/knowledge/.

All of this is not simply a matter of ticking boxes. It is a practical exercise in risk management and budget planning. The minimums are the floor, not the ceiling. Every driver should consider how much protection they want beyond the baseline. The numbers captioning bodily injury and property damage are a guide to potential exposure, but the real question is what would happen if an accident occurred and costs exceeded the minimums. Medical costs, long-term care, vehicle replacement, and the ripple effects on a family’s financial security are the realities behind the policy price tag. Many households find that increasing liability limits is a prudent hedge against the unpredictable costs of modern crashes, even if it means a higher premium. The calculus blends current income, savings reserves, existing debt, and future financial plans. The goal is to create a level of readiness that reduces the likelihood of hardship in an emergency, while keeping coverage affordable enough to prevent people from going without protection altogether. In this sense, the FRL is a living instrument that adapts to the contours of a family’s financial life and a state’s policy priorities, while staying anchored to a simple, human aim: that those harmed by auto accidents are treated with fairness and that communities retain a measure of resilience in the face of accident-related costs.

For those who want a concise snapshot of where to look next, the broader transportation-finance ecosystem offers a coherent map. The National Association of Insurance Commissioners remains the authoritative, cross-state resource for up-to-date minimums and related regulatory developments. Meanwhile, the knowledge hub mentioned earlier provides a gateway to connected topics at the intersection of money and mobility, making it easier to translate regulatory concepts into personal planning decisions. Remember that the FRL’s minimums are not merely a legal form to fill out; they are a signal about how a society chooses to handle risk, protect the vulnerable, and allocate responsibility when the road is the site of mishap. By understanding the architecture behind these requirements, drivers can make informed choices that honor both their own financial stability and the safety net of the community. The law exists to ensure that, when the worst happens, compensation is available, process is predictable, and the road remains, in effect, a shared space held together by a common duty to respond, repair, and recover. For those seeking the most authoritative, state-by-state details, consult the official resources and regulatory bodies that govern auto liability—and remember that the FRL is a practical tool for turning protection into action on every mile traveled on public roads.

External Resource: For authoritative, state-specific details, consult the National Association of Insurance Commissioners at https://www.naic.org.

Beyond Insurance: Navigating Alternative Proofs of Financial Responsibility under the Auto Financial Responsibility Law

The Auto Financial Responsibility Law builds a foundation for accountability after a crash by requiring vehicle owners to demonstrate the ability to cover damages. In practice, the most familiar path is auto liability insurance, with minimum coverage requirements that vary from state to state. Yet the law also recognizes a spectrum of alternative proofs of financial responsibility. These alternatives are not mere curiosities; they shape who can drive, how obligations are met, and how victims are compensated when bad outcomes occur. The core idea is simple: if a driver cannot or will not carry standard insurance, they must still show they can meet the financial consequences of an accident. Regulations reflect this balance between individual circumstances and the broader aim of protecting injured parties and safeguarding public resources. The question, then, becomes not just what the law requires, but how the available options function in different states, what risks they carry, and how drivers can navigate them with financial clarity and legal certainty.

Among the recognized options, a surety bond stands out as one of the most structured alternatives to traditional insurance. A surety bond ties three parties together: the vehicle owner as the principal, the bonding company as the surety, and the state as the obligee. The bond guarantees payment of damages up to a defined limit if the driver cannot satisfy a judgment or settlement after an accident. In many jurisdictions, the bond amount closely mirrors the minimum liability limits or an alternative threshold chosen by the state. The appeal of a bond lies in avoiding the immediate depletion of personal funds while still presenting a credible commitment to satisfy claims. However, bonds come with ongoing costs in the form of premiums, and they require vigilance: the bond must stay active, claims processes must be navigated when disputes arise, and the provider can terminate coverage under specific conditions. For someone weighing this option, the math matters as much as the legal form—premium costs can accumulate, and a lapse can trigger penalties just as a lapse in insurance would.

A cash deposit presents another clear-cut path. In this arrangement, the driver places a specified sum with the state’s motor vehicle department or related agency, creating a reserve that can be drawn upon to compensate victims in the event of a crash. The cash serves as a tangible statement of solvency and provides a direct funding source for liabilities. The upside is straightforward: funds are readily available to satisfy judgments up to the deposit limit, reducing the need to chase after an insurance settlement. The trade-offs, however, are substantial. The money is not freely accessible for other uses, and its availability can depend on state rules, deposit terms, and administrative processes. Deposits can also miss the flexibility that insurance offers, such as optional add-ons for medical payments or property damage beyond a narrow cap. In practice, a deposit works best for drivers who have liquidity to spare and who prefer a transparent, auditable form of proof, rather than for those who need maximum access to funds for everyday expenses or investments.

Self-insurance marks the frontier of these alternatives and is typically reserved for individuals or organizations with substantial financial resources. Rather than transferring risk to a third party, a self-insured driver asserts that they have sufficient reserves to cover potential liabilities and will manage those losses directly. States that permit self-insurance usually require a rigorous demonstration of financial strength, including balance sheets, liquidity ratios, and sometimes a formal plan outlining how reserves will be maintained against future claims. In return for this autonomy, the driver faces ongoing responsibilities: regular financial reporting, compliance reviews, and a credible claims process that ensures victims are treated equitably. Self-insurance can be attractive to large fleets or high-net-worth individuals who prefer to control risk management in-house and who have the capacity to absorb losses without the friction of dealing with insurers. Yet the arrangement is not without risk. A single large claim or a string of expensive incidents can stress even substantial reserves, and the regulatory review that accompanies self-insurance heightens the need for disciplined financial governance.

The landscape across states is diverse. Some jurisdictions rely almost exclusively on minimum auto liability insurance and view alternatives as supplementary or limited to particular cases. Others embrace flexibility, allowing bond, deposit, or self-insurance options under clearly defined criteria. The common thread is the enforcement mechanism: the state DMV or its equivalent verifies compliance, conducts post-accident checks, and imposes penalties for noncompliance. Penalties can range from license suspensions and vehicle registration holds to fines and, in severe cases, the loss of driving privileges for extended periods. As a result, individuals considering nontraditional proofs should approach the process with careful planning and precise documentation. The requirement is not merely about meeting a number on a form; it is about sustaining a demonstrable, ongoing capacity to meet obligations to those harmed in crashes. The balance sought by these rules is one of accessibility and protection—ensuring people can drive while still guaranteeing that victims have reliable channels for compensation.

For a driver exploring these options, practical steps begin with an honest assessment of state rules. The starting point is the official guidance from the state’s DMV or motor vehicle authority, which outlines acceptable proofs and the steps needed to obtain and maintain them. If the choice falls on a surety bond, shoppers should compare terms across reputable providers, understand premium structures, and confirm how the bond remains in effect during the FRL coverage period. When a cash deposit seems appealing, it is essential to evaluate liquidity, the opportunity costs of tying up funds, and any state-specific rules about earning interest or releasing funds. Self-insurance requires a rigorous preparation of financial documents and an understanding of ongoing regulatory obligations. Across all routes, compiling a robust portfolio of financial records helps a driver present a credible case to the state and to any later claimants. These records typically include net worth statements, liquidity analyses, lines of credit, income documents, and tax records. Such preparation is not merely bureaucratic formality; it is a reflection of a driver’s readiness to meet liability obligations in real time, after a crash has occurred.

A broader perspective on the FRL connects these technical choices to the victims and to public safety. The law is designed to secure reliable compensation while discouraging behaviors that shift the burden onto others or onto government resources. Alternative proofs preserve the underlying principle but shift the mechanism of availability—from an insurance pool to a driver’s own financial architecture. Victims benefit when the vehicle owner’s commitment to payment is explicit and enforceable, and the state’s oversight helps ensure that commitment remains legitimate over time. For drivers, this means recognizing that a move away from traditional insurance is not a loophole but a different channel with its own requirements, costs, and risks. The social contract presumes that harm will be addressed through predictable, enforceable means, irrespective of the vehicle type or location. The regulatory debate, then, centers on how to preserve that predictability while accommodating diverse financial realities.

Misconceptions can cloud judgment. It is not inherently easier or cheaper to pursue an alternative; the decision hinges on personal circumstances, risk tolerance, and the capacity to sustain a long-term financial obligation. Self-insurance can be a prudent choice for those with substantial assets and disciplined budgeting, but it demands continuous oversight. A bond may be suitable for someone who prefers a third-party guarantor yet is comfortable with premium volatility and renewal terms. A cash deposit provides transparency and immediacy but sacrifices liquidity. In each case, the crucial task is to translate abstract requirements into a concrete, defendable plan that a state regulator can verify and a potential claimant can trust. This careful alignment between financial reality and regulatory expectations is what makes the chapter on alternative proofs essential to a thorough understanding of auto financial responsibility.

The journey through alternatives to traditional auto insurance thus opens a broader conversation about risk, responsibility, and the ways communities organize civil liability. As states experiment with different models, drivers gain a menu of options that reflect varied financial landscapes. The central takeaway is not simply the existence of these options but the necessity of diligent preparation, ongoing compliance, and a clear understanding of how each path affects both driving behavior and the likelihood of prompt compensation after an crash. For readers seeking further context, the Davis Financial Advisors Knowledge resource provides additional perspectives on how financial planning intersects with transportation risk management. Davis Financial Advisors Knowledge

For those who want to explore official guidance directly, the state-focused resource that collates definitions, requirements, and enforcement protocols is available at the DMV community site. The external reference offers practical, up-to-date information on how financial responsibility is assessed and maintained across different scenarios, including how to verify compliance and what happens if a driver’s chosen path is challenged by regulators. See https://www.dmv.org/automotive-legal/financial-responsibility.php for a comprehensive overview and state-specific nuances that can affect eligibility, timelines, and documentation requirements.

When Financial Responsibility Fails: Penalties, Protections, and the Path to Compliance

The Auto Financial Responsibility Law is more than a rule about buying car insurance. It is a framework that links mobility to accountability, a social contract designed to ensure that when harm occurs, the costs are addressed without unduly burdening victims or the public purse. In most states, demonstrating the ability to pay for damages from crashes is the default expectation for vehicle owners and operators. That demonstration typically comes in the form of auto liability insurance that meets or exceeds state-specific minimums. The logic is simple in theory: if you cause an accident, you should have the means to compensate those who are injured or whose property is damaged. In practice, the exact requirements shift from one jurisdiction to another, with some states allowing alternatives such as surety bonds or cash deposits. The variation matters because the penalties for failing to comply are calibrated to enforce the same underlying objective across very different legal landscapes: protect victims, encourage responsible driving, and prevent unresolved costs from accumulating in the public system. Understanding how penalties are structured, therefore, is essential for anyone who relies on a vehicle for work, family, or daily life. It is not merely a matter of avoiding fines; it is about preserving access to mobility in a way that remains fair to others who share the road. To put the penalties in perspective, consider how enforcement mechanisms translate into real-world consequences and how they intersect with a driver’s routine. When a driver loses financial responsibility, the impact ripples through administrative processes, courts, and everyday schedules. The penalties are designed to be immediate enough to deter non-compliance while allowing a pathway back to lawful operation once the underlying issue is resolved. The underlying question is not only what happens if you fail to comply, but how a coherent system can function when a lapse occurs, how it supports victims, and how it nudges drivers toward lasting, affordable coverage. A practical takeaway for most readers is that the law is rarely invoked in a vacuum. It operates in a network of verification checks, accident follow-ups, and interagency collaboration that keeps information aligned across agencies and insurers. In this light, the penalties serve as both a stick and a carrot: the stick to emphasize consequences and the carrot to reward timely restoration of compliance, often through reinstatement processes, documented insurance, and reduced risk exposure for the future. For readers seeking a concise primer on how these pieces fit together, the Knowledge resource offers foundational context that helps connect the dots between policy goals and everyday driving reality. Knowledge.

Driving Accountability: How Auto Financial Responsibility Laws Shape Safer Streets

At its core, the Auto Financial Responsibility Law establishes a floor in the economic calculus that accompanies every drive. It asks drivers to demonstrate they can pay for the harm they might cause. This is not a niche regulatory quirk; it is a social contract designed to protect victims and to keep the costs of crashes from spilling over into public budgets and private hardship. The clearest expression of FRL is the requirement to carry auto liability insurance at a minimum level of coverage. Drivers must be able to cover injuries to others and damage to their property. The exact limits differ by state, reflecting local costs of healthcare, construction, and the relative risk environment. In practice, this framework primarily relies on insurance as the mechanism to prove financial responsibility. Insurance pools risk across many drivers, so a single accident does not derail one person’s finances, and victims have access to compensation without litigation fatigue. Some jurisdictions, however, do allow alternative forms of proof, such as surety bonds or cash deposits, but these options are far rarer and less familiar to most motorists. Where insurance remains the norm, the law uses a straightforward but powerful logic: if you are financially unprepared to pay for damages, you may not be legally allowed to operate a vehicle until you restore that capacity. The consequence of noncompliance is concrete—license suspensions, registration blocks, and fines that can accumulate quickly and complicate everyday life. Enforcement is not a single moment in time; it is a continuous process, with periodic checks and post-accident verifications designed to keep the status of a driver’s financial responsibility current. This ongoing oversight helps ensure that the penalty is not merely punitive but preventive, maintaining a baseline of accountability for all road users.

The moral premise behind FRL is simple but powerful: driving is a risk-laden activity whose costs should be borne by those most capable of paying. When a driver knows that an accident could trigger substantial financial exposure, the calculus of risk changes. The law translates abstract risk into a tangible cost, one that can be reflected in premiums, deductibles, and the choice to invest in safer vehicles, defensive driving courses, or more comprehensive coverage. In this sense, the FRL acts as a deterrent against reckless or negligent behavior, not by policing every choice but by making the consequences of dangerous driving economically visible. It is not a panacea for unsafe roads, but it does embed a financial check that complements other safety measures—engineering standards, traffic enforcement, and public awareness campaigns. Even drivers who favor a minimalist approach to coverage at first glance understand that a crash could produce medical bills and repair costs far beyond their daily resources. The policy landscape, therefore, becomes a conversation about balance: how to set minimums high enough to protect victims without creating barriers that make insurance unaffordable or inaccessible for otherwise responsible drivers.

From a policy standpoint, FRLs serve several interconnected purposes. They shore up victims’ rights by guaranteeing a path to compensation, reduce the burden on public services, and encourage prudent behavior behind the wheel. They do not exist in a vacuum; they ride on a broader system of enforcement, consumer information, and market dynamics. In states that regularly revisit minimum coverage levels, policymakers respond to shifts in healthcare costs, vehicle repair costs, and the prevalence of high-severity crashes. Ohio, for example, is often cited as a practical reference point because its framework centers on a clear obligation to maintain adequate liability coverage, with defined thresholds and accessible guidance for drivers. Such examples illustrate how FRLs translate abstract financial responsibility into concrete, enforceable rules that most people can comprehend. For readers seeking context and a deeper dive into the financial planning lens that underpins these rules, the Knowledge Resources page offers foundational materials that connect personal finances with everyday mobility decisions. Knowledge Resources

The practical implications of FRL extend to household budgeting and risk management. Families thinking about insurance may weigh the trade-offs between higher coverage and lower premiums, or between broad protections and niche riders that shield against specific risks, such as uninsured motorists or medical payments while traveling. Car ownership becomes a matter of ongoing budgeting as much as it is a legal obligation. The law’s reach also intersects with consumer protection—information about coverage limits, exclusions, and the process for filing claims matters just as much as the existence of the minimums themselves. When a driver experiences a lapse in coverage, the consequences can disrupt routine life: a sudden stop at a DMV window, a temporary loss of driving privileges, or delays in renewing registration. These disruptions are not merely bureaucratic hassles; they are friction that nudges drivers toward maintaining continuous coverage, a habit that pays off in the long run by reducing the risk of being uninsured or underinsured after an accident.

Cognizant of the fact that road safety arises from multiple layers, many states couple FRL with public information campaigns, welcoming educational programs that help drivers understand their obligations and choices. The financial incentive to avoid crashes is reinforced by the social expectation that drivers who harm others will be able to make them whole. In turn, this fosters safer driving habits, encouraging people to stay within posted speed limits, to use seat belts, to avoid distracted driving, and to prepare for emergencies with well-maintained vehicles. The friction created by potential losses—losses that could derail a family’s finances or a business’s cash flow—helps align personal choices with societal welfare. It is not merely about avoiding penalties; it is about recognizing that mobility comes with responsibility, and that responsibility is supported by financial arrangements that make harm less likely to become harm that collapses someone’s financial future.

As you navigate these ideas, it is helpful to keep in mind that the FRL is part of a broader safety ecosystem. It interacts with insurance markets, regulatory oversight, and public safety initiatives. It also invites ongoing refinement as costs change and technologies evolve. The advent of safer vehicle designs, better crash-resistance features, and advanced driver-assistance systems can influence how states think about minimums over time. Yet even in an era of evolving vehicle safety, the core message of FRL remains consistent: driving is a choice that carries a predictable consequence in the form of financial responsibility. This core message helps explain why FRLs are widely adopted across the United States and why they continue to shape both personal behavior and policy design. For those who want to see how these ideas play out in practice, the external resource at the end of this chapter provides an official, state-level perspective on enforcement and guidelines, illustrating how the theory translates into everyday rules of the road. For official guidelines, see the Ohio Department of Public Safety: https://www.dps.ohio.gov.

Final thoughts

Navigating the complexities of the Auto Financial Responsibility Law is essential for both individual car buyers and businesses. Understanding the insurance requirements, exploring alternative proofs of financial responsibility, and recognizing the consequences of non-compliance can enhance your decision-making process. By grasping how the law promotes accountability and encourages safer driving practices, stakeholders can better protect themselves and others on the road. Awareness and adherence to these regulations not only foster a responsible driving culture but also ensure the financial safety of all involved.